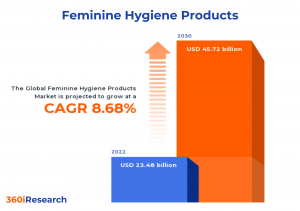

Feminine Hygiene Products Market worth $45.72 billion by 2030- Exclusive Report by 360iResearch

The Global Feminine Hygiene Products Market to grow from USD 23.48 billion in 2022 to USD 45.72 billion by 2030, at a CAGR of 8.68%.

PUNE, MAHARASHTRA, INDIA , December 8, 2023 /EINPresswire.com/ -- The "Feminine Hygiene Products Market by Nature (Disposable, Reusable/ Organic), Type (Menstrual Cups, Panty Liners, Sanitary Napkins), Distribution Channel - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Feminine Hygiene Products Market to grow from USD 23.48 billion in 2022 to USD 45.72 billion by 2030, at a CAGR of 8.68%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/feminine-hygiene-products?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

Feminine hygiene products are personal care items used to cleanse and maintain intimate hygiene. These products include pads, tampons, panty liners, menstrual sponges, and menstrual cups that help women comfortably manage their menstrual cycles. The rise in the number of female working population and increase in disposable income has raised women's purchasing power, leading to elevated sales of feminine hygiene products. The use of feminine hygiene products has increased due to increasing awareness of the significance of maintaining proper sanitation and increasing accessibility on eCommerce platforms and in convenience stores. However, the adverse effects and environmental concerns associated with the disposal of products manufactured from synthetic materials and chemicals may impede their use by the female population. Besides, the ongoing development and introduction of innovative and reusable products are expected to encourage the adoption of feminine hygiene products by women worldwide.

Distribution Channel: Rising accessibility of feminine hygiene products through online platforms due to their convenience

Convenience stores are a popular destination for last-minute purchases that offer a limited range of products and usually have higher prices due to their small scale of operation and 24/7 accessibility. Drug stores or pharmacies are the main go-to source for health-related products and, thus, offer a vast range of feminine hygiene products. Hypermarkets & supermarkets are the preferred choice for most female consumers due to the wide variety of brands available. They serve as a one-stop solution and enable consumers to compare product features, prices, and quality. With the growth of e-commerce, online retail stores and direct-to-consumer brands have been burgeoning distribution channels. They offer convenience, comparatively lower prices, more comprehensive product information, and a broad range of products.

Type: Increasing potential of tampons among eco-conscious consumers

Menstrual cups, reusable devices made from silicone or rubber, are inserted into the vagina during menstruation to collect menstrual fluid. With environmental concerns on the rise, these can replace disposables, marking a significant shift in feminine hygiene preferences. Panty liners are a mainstay for women seeking light absorbency during the menstrual cycle or for everyday freshness. Sanitary napkins remain the most commonly used type of menstrual management product. Tampons are the preferred choice for many women due to their compact design and ease of use, particularly for those leading an active lifestyle. Urinary incontinence products, such as liners, pads, and panties, have grown increasingly popular with the aging population and are a vital part of the market.

Nature: Expanding usage of reusable/organic feminine hygiene products to reduce their carbon footprint

Disposable feminine hygiene products, such as conventional sanitary pads, tampons, panty liners, and menstrual cups, are single-use items appreciated for their convenience and accessibility. They are made from materials such as paper, plastic, and absorbent cores and are convenient but generate waste. The preference for disposable hygiene products is commonly justified by the demand for convenient and hassle-free menstrual hygiene solutions. Reusable/organic feminine hygiene products are designed for menstrual care and personal hygiene and are intended to be used multiple times. These products, including cloth pads, menstrual cups, and period underwear, are made from durable, washable materials, including cloth, silicone, or fabric. They are more environmentally sustainable and cost-effective in the long term compared to disposable alternatives.

Regional Insights:

The Americas showcase a significant landscape for feminine hygiene products attributed to the increasing awareness of feminine health and sanitation among the women population and advancements in female sanitation products. Several rapidly growing economies, including India and China, are showcasing growing sales for hygiene products due to massive female population growth. In addition, feminine hygiene product startups have observed favorable landscape and funding options in the Asia-Pacific region. In Europe, the increasing literacy rate among females and high disposable incomes among the EU population support the demand for female hygiene products. Several regional players collaborated with other business entities and non-governmental organizations to promote cost-effective sanitary napkins and pads. Additionally, African governments are taking initiatives to provide affordable access to sanitary pads in rural areas.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Feminine Hygiene Products Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Feminine Hygiene Products Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Feminine Hygiene Products Market, highlighting leading vendors and their innovative profiles. These include Bella, Bingbing Paper Co., Ltd., Blood, Carmesi, Corman S.p.A., Cotton High Tech - Cohitech, Dabur India Ltd, Daye, Diva International Inc., Drylock Technologies, Edgewell Personal Care, Essity Aktiebolag, First Quality Enterprises, Inc., Hengan International Group Company Limited, Honey Pot Company, LLC, Johnson & Johnson Services, Inc., Kao Corporation, Kimberly-Clark Corporation, Lambi, Lola by Alyk, Inc., MeLuna, Natracare LLC, Natratouch, Niine Private Limited, Ontex BV, Premier FMCG, Procter & Gamble, Redcliffe Hygiene Private Limited, Sirona, The Honest Company, Inc., Trace Femcare, Inc., Unicharm Corporation, Veeda, and Yoona Digital Indonesia.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/feminine-hygiene-products?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Feminine Hygiene Products Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Nature, market is studied across Disposable and Reusable/ Organic. The Reusable/ Organic is further studied across Menstrual Cup, Panty Liners, Sanitary Napkins, and Tampons. The Disposable commanded largest market share of 91.24% in 2022, followed by Reusable/ Organic.

Based on Type, market is studied across Menstrual Cups, Panty Liners, Sanitary Napkins, Tampons, and Urinary Incontinence Products. The Menstrual Cups is further studied across With Applicator and Without Applicator. The Panty Liners is further studied across Thick and Thin. The Sanitary Napkins is further studied across Extra Large, Large, and Regular. The Extra Large is further studied across Thick and Thin. The Large is further studied across Thick and Thin. The Regular is further studied across Thick and Thin. The Tampons is further studied across Applicator and Non-applicator. The Sanitary Napkins commanded largest market share of 56.54% in 2022, followed by Urinary Incontinence Products.

Based on Distribution Channel, market is studied across Convenience Stores, Drug Stores or Pharmacies, Hypermarkets & Supermarkets, and Online Retail Stores. The Hypermarkets & Supermarkets commanded largest market share of 34.56% in 2022, followed by Drug Stores or Pharmacies.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Europe, Middle East & Africa commanded largest market share of 38.39% in 2022, followed by Americas.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Feminine Hygiene Products Market, by Nature

7. Feminine Hygiene Products Market, by Type

8. Feminine Hygiene Products Market, by Distribution Channel

9. Americas Feminine Hygiene Products Market

10. Asia-Pacific Feminine Hygiene Products Market

11. Europe, Middle East & Africa Feminine Hygiene Products Market

12. Competitive Landscape

13. Competitive Portfolio

14. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Feminine Hygiene Products Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Feminine Hygiene Products Market?

3. What is the competitive strategic window for opportunities in the Feminine Hygiene Products Market?

4. What are the technology trends and regulatory frameworks in the Feminine Hygiene Products Market?

5. What is the market share of the leading vendors in the Feminine Hygiene Products Market?

6. What modes and strategic moves are considered suitable for entering the Feminine Hygiene Products Market?

Read More @ https://www.360iresearch.com/library/intelligence/feminine-hygiene-products?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.