TELF AG Report on Base Metals and Battery Materials Sheds Light on Mixed Performance Amidst Weaker US Dollar

TELF AG today released its report on the base metals market and its implications for the battery materials industry.

According to TELF AG's report, the base metals market experienced a mixed performance in June 2023, as indicated by fluctuations in futures prices on the London Metal Exchange (LME). Copper, a key base metal, showcased strength with a 1.7% increase, reaching $8,315.50 per tonne. This positive sentiment suggests a favorable outlook for copper, which is extensively used in construction and electrical equipment manufacturing industries. Conversely, aluminum witnessed a decline of 0.4%, settling at $2,151.50 per tonne, while nickel experienced a slight decrease of 0.6%, reaching $20,516 per tonne. As per the report, these movements reflect a more cautious approach, possibly influenced by specific supply-demand dynamics and market conditions.

TELF AG's analysis reports that one of the contributing factors to the base metals' performance was the weaker US dollar. The depreciation of the US currency makes base metals more attractive to foreign buyers using other currencies, positively affecting their prices. This boost from the weaker dollar likely contributed to the overall strength displayed by the base metals complex.

According to the report, inflation data also played a role in shaping market sentiment. The US consumer expenditures price (PCE) index, a crucial measure of inflation for the US Federal Reserve, revealed a 3.8% year-on-year increase in May. While slightly lower than the 4.3% recorded in April, it still indicates a persistent inflationary environment. The rise in inflation was primarily driven by energy prices, which experienced a notable decline during the period under review. These figures significantly impact the Federal Reserve's decision-making process regarding interest rate hikes. The moderation in consumer expenditure inflation and falling energy prices have dampened the US dollar and provided support for US equity markets.

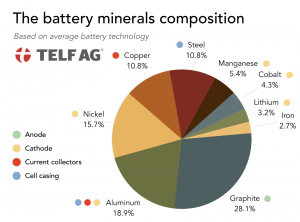

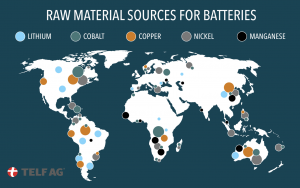

An analyst at TELF AG said that the performance of base metals holds significant implications for the battery materials industry, given their crucial role in battery production. With its excellent conductivity and durability, copper is widely used in electric vehicle (EV) batteries, pointing to a positive outlook for the EV industry and battery materials demand.

The report also examines aluminum and nickel's role in the current outlook. Despite their recent declines, the two metals also play integral roles in battery technology. Aluminum contributes to lightweighting efforts to enhance EV efficiency, while nickel is an essential component of lithium-ion batteries powering various electronic devices. The mixed performance of these metals highlights the importance of continued monitoring of market conditions and demand trends within the battery materials sector.

TELF AG's Analyst stated, "The base metals market's mixed performance, influenced by the weaker US dollar and inflation data, underscores the need for stakeholders in both the base metals and battery materials sectors to stay vigilant. The performance of base metals holds implications for the battery materials industry, especially in the context of electric vehicles and energy storage. By adapting to changing dynamics and capitalizing on emerging opportunities, stakeholders can position themselves advantageously in this evolving landscape."

To access the full TELF AG 2023 Week 27 Market Round-Up report, please visit: https://telf.ch/telf-ag-2023-market-roundup-week-27/

To access TELF AG's report on Base Metals and Battery Materials, please visit: https://telf.ch/telf-ag-report-on-base-metals-and-battery-materials-july-10-2023/

About TELF AG:

TELF AG is a full-service international physical commodities trader with 30 years of experience in the industry. Headquartered in Lugano, Switzerland, the company operates globally, serving customers and providing solutions for commodities producers worldwide. TELF AG works in close partnership with producers to provide effective marketing, as well as financing and logistics solutions, which enable suppliers to focus on their core activities and to access far-reaching markets wherever they may be.

Its flexible, customer-focused approach allows TELF AG to create tailor-made solutions for each producer, thereby facilitating long-term partnerships. Additionally, consumers widely recognize them for their operational excellence and reliability.

Rick De Oliveira

TELF AG

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram

YouTube

Other

TELF AG - Cobalt is a crucial element for the production of batteries and electric vehicles, making it one of the essential minerals worldwide.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.