InsuredMine CRM Adds Powerful New NPS Survey To Platform

With our new NPS Score feature, insurers are finally able to harness the power of customer feedback to drive improved customer experiences, loyalty, and business growth”

PLANO, TEXAS, UNITED STATES, June 1, 2023/EINPresswire.com/ -- InsuredMine, the leader in cutting-edge Insurance CRM is thrilled to announce its revolutionary new NPS Survey feature. The launch represents an important breakthrough for insurers and policyholders alike, further solidifying InsuredMine's commitment to innovation and customer-centric solutions in reputation management.— Raution Jaiswal, InsuredMine CEO and founder

The Net Promoter Score (NPS) helps agencies determine how they stack up against the competition. It provides a valuable measure of consumer loyalty and their tendency to recommend or renew their insurance agency (or abandon it for someone else). In another move to create the most complete insurance CRM available, InsuredMine’s NPS Review has myriad benefits. The addition of this powerful feature enables insurance professionals to collect important insights into their clients' experiences, opening up new possibilities for enhanced customer engagement and retention.

Net Promoter Score is widely regarded as the gold standard in measuring customer loyalty and satisfaction. With this feature launch, it is now seamlessly integrated into InsuredMine's comprehensive platform. Now, agents can view, send, and utilize NPS Survey and Google Review in the engagement module. It’s now easier than ever to evaluate scores in the NPS dashboard and then create automation with the goal of boosting the number of positive evaluations through effective, targeted communications.

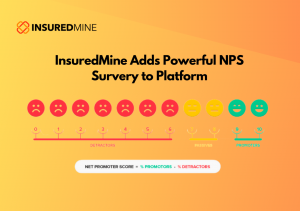

What the dashboard feature does is aggregate NPS scores in the form of easy-to-read charts. Scores fall into 3 categories based on a scale of 1 to 10. Detractors are all the 1 to 6 reviews, passives are 7 to 8, and promoters are all the reviews from 9 to 10. The NPS score is then calculated by deducting the number of detractors from the number of promoter reviews.

Streamlining NPS empowers insurance agencies to collect and utilize customer feedback effectively. When agencies can gain a comprehensive understanding of customer satisfaction, identify areas for improvement, and drive positive outcomes for their business, they become better positioned to retain existing clients and bring in new ones. When agencies are aware of their NPS, it’s easier to address any pain points while doubling down on the more favorably scored features and functions. When agencies work towards improving NPS, they are employing data to create solutions that ultimately make the business better in terms of service, performance, and customer satisfaction. A better business yields a higher NPS so the metric is directly related to success.

"An insurance agency is a retention business and only those who understand their customer, read their pulse and build strong relationships will win,” said Raution Jaiswal, CEO of InsuredMine. “NPS score is one such measure to get them closer to their clients. With our new NPS Score feature, insurers are finally able to harness the power of customer feedback to drive improved customer experiences, loyalty, and business growth.”

InsuredMine specializes in providing an innovative platform for insurance agencies that puts the entire insurance management process into a powerful all-in-one resource. With a comprehensive suite of tools, including CRM, marketing automation, analytics, and more, InsuredMine continues to revolutionize the way insurers can engage with and provide superior service for their clients.

InsuredMine leverages advanced technology to streamline operations, enhance customer experiences, and drive growth. For more information about InsuredMine's NPS Score feature, visit the knowledge base section of their website and register for a demo.

Raution Jaiswal

InsuredMine

donotreply@insuredmine.com

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.