Disruptive Technology to Predict Strokes Using Image of the Eye to Begin Clinical Trials - DIAGNOS Inc. Special Advisory

Success in early detection of cardio vascular issues in a non-invasive manner apt to propel shares of DIAGNOS Inc. (TSX-V: ADK) (OTCQB: DGNOF) (Frankfurt: 4D4)

DIAGNOS Inc. (TSX:ADK)

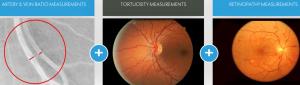

NEW YORK, NY, USA, November 24, 2021 /EINPresswire.com/ -- DIAGNOS Inc. (TSX-V: ADK) (OTCQB: DGNOF) (Frankfurt: 4D4) is a Canadian-based medical software technology company that pioneered 'Computer Assisted Retinal Analysis' (CARA), which automatically analyses the retina (located at the back of the eye) using machine learning / artificial intelligence (AI) technology to identify damage caused by diabetes and cardiovascular issues. Complicated medical conditions resulting from diabetes, high blood pressure, and potential stroke can be detected by DIAGNOS' algorithms able to interpret detailed imagery of the retina. This week DIAGNOS Inc. announced it will be begin clinical trials with CommonSpirit Health Research Institute in the USA starting December 6, 2021. DIAGNOS is the subject of a Technology MarketWatch Journal review, full copy may be seen at https://technologymarketwatch.com/adk.htm online.

For the last 7 years DIAGNOS has commercially advanced its first large-scale application of its technology, primarily aimed at preventing diabetic retinopathy. Entering 2022 marks a pivotal time for DIAGNOS as the technology has recently seen several large players in the eyecare sector and medical field commit to large-scale roll-outs, this is putting pressure on others in the sector to consider a similar move and not be left behind. DIAGNOS' technology essentially transforms eyecare centers into Point of Care and wellness diagnostic centers as the CARA platform also is expected to commercially launch several other large-scale applications, including an application for hypertensive retinopathy (launch imminent) and one for stroke prediction (now entering clinical trials).

Having a stroke can lead to life-debilitating paralysis. DIAGNOS is starting a clinical trial in the second largest hospital group in the US (CommonSpirits; which has ~137 hospitals and >1,000 clinics, in 21 states) to prove DIAGNOS can predict if an individual will have a stroke using the same fundus camera image of the back of the eye. DIAGNOS is doing a clinical trial study in collaboration with them as they see the CARA platform as an important tool to reduce costs long-term and provide rapid feedback on the effectiveness of individual patient’s medication. If the planned trials for the Stroke Predictor demonstrates the level of accuracy that DIAGNOS has encountered in its development stages, Market Equities Research Group has stated Pharma professionals have told its analyst "...look for shares of ADK.V to trade well above $5/share and the Company to eventually become the subject of buyout. The 'Stroke Predictor' application can state the probability of someone having a stroke in the next two years and it will also tell you why. Success in early detection of cardio vascular issues in such a non-invasive manner for the patient could quickly result in the DIAGNOS being a go-to service in a massive market place that currently spends >US$500 Billion a year in drugs and services for cardiovascular and stroke issues. DIAGNOS' technology can also quickly reveal if a patient's medication is working by showing changes in condition (progression or regression). Pharma and the medical community will pay up for this technology and DIAGNOS Inc. will no longer resemble what it is today."

Since New Look (with 407 locations in Canada) signed on for CARA platform roll-out DIAGNOS' phone has been ringing from around the globe, essentially other industry participants do not want to miss out on a technology whose time has come. Look for an increase in new business announcements to come from the DIAGNOS over the coming months and years. In fact, Essilor Luxottica (Euronext Paris Stock exchange: EL), the largest eyecare company in the world, with EUR$16+ Billion in revenue and ~15,000 locations, signed a MOU with DIAGNOS in August-2021 and is in active negotiations on terms -- this alone has massive latent catalyst potential for upside share price revaluation of ADK.V as details emerge. Specifically DIAGNOS and Essilor are currently negotiating 3 things; 1) contract for the existing platform, 2) Essilor wants DIAGNOS to do a specific development for their line of fundus camera, and 3) Essilor wants access to future applications DIAGNOS will roll out. The fact the largest eyecare company in the world chose DIAGNOS' technology speaks volumes as to where this is headed.

With all the activity DIAGNOS has on the go it appears a low-risk high-reward proposition: ADK.V only has 69.12 million shares outstanding, there are very little warrants left, and insiders & family office own ~40% of the outstanding shares. DIAGNOS has no debt, money in the bank, an untapped C$2 million government credit line if needed, has a high-margin SaaS model (it only costs ~4 cents to process an image that it charges between ~C$5 - $10), is expected to be cash flow positive (based on solid contracts) in the coming fiscal year, has numerous new business prospects in discussion now, and is expected to see rapid revenue growth. Astute investors connecting the dots about what is unfolding are apt to do well by establishing a long position in ADK.V now.

DIAGNOS Inc. received its first institutional coverage from the independent investment bank / advisory / equity research firm Echelon Capital Markets, its current rating is 'Top Pick', 'Speculative BUY' with a near-term (12 month) target price per common share of DIAGNOS of $1.55 Canadian (or in US dollars: USD$1.23 or in Euros: €1.09) -- click here [PDF] to view full copy of their latest report. Note, the analyst share price target is based on the DIAGNOS’ CARA Platform that is currently in use and does not include progress on the Stroke Predictor application that was the subject of clinical trial news this week – needless to say a much higher share price target is justified if success in the clinical trials is demonstrated.

See the full Technology MarketWatch Journal review at https://technologymarketwatch.com/adk.htm online.

Content above may contain forward-looking statements regarding future events that involve risk and uncertainties. Readers are cautioned that these forward-looking statements are only predictions and may differ materially from actual events or results. Articles, excerpts, commentary and reviews herein are for information purposes and are not solicitations to buy or sell any of the securities mentioned.

Fredrick William

Market Equities Research Group

8666209945

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.