Rong360 Jianpu Technology(NYSE:JT): The Deadline for Converting Mortgage Rate for Existing Home Loans is Approaching

Jianpu Technology (NYSE:JT)

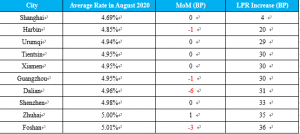

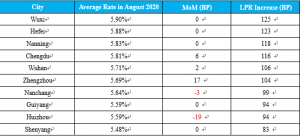

BEIJING, CHINA, September 10, 2020 /EINPresswire.com/ -- Ranking: Kunming Left the Top 10 Cities for the Lowest Mortgage Rate; Huizhou Became the Top 9 City in the Highest Rate Ranking NationwideIn August 2020 (with data in statistics collected from July 20, 2020 to August 18, 2020), Kunming left the top 10 cities for the lowest first-home mortgage rate as the rate in the city increased to more than 5% which was higher than Foshan that was ranking No. 10 on the list. Among the top 10 cities for the highest first-home mortgage rate in the last month, Suzhou and Huizhou both cut down largely on their rates, therefore Suzhou left the top 10 for highest rates while Shenyang got in. Huizhou was still in the list but fell to No. 9.

Trends: The Deadline for Converting Mortgage Rate System for Existing Home Loans is Approaching; Two Types of Misunderstanding on the Conversion Need to Be Clarified

On August 17, 2020, the People’s Bank of China injected RMB700 billion of medium-term lending facility (MLF) into the market, and there is a total volume of RMB550 billion to be matured in August. Different from the stance of net liquidity withdrawal in the past two months, the injected amount for this time significantly increased. While the rate for the MLF operation was maintained at 2.95%, same as the last month. It was unsurprising that the MLF rate remained unchanged in consideration of a flexible and moderate monetary policy with effective guidance for the flow of credit resources to the real economy. The loan prime rate (LPR) in August is expected to remain unchanged, and the possibility of a broader decline of mortgage rates is extremely low.

The deadline for converting the mortgage rate on the existing home loans to LPR is approaching. China's six major state-owned banks made announcement respectively of that it will adjust the mortgage rate on the existing individual housing loans to a LPR-based floating rate in late August. However, the mortgage borrowers have the right to request for reversing back to fixed rate or in negotiation with the corresponding bank before December 31, 2020.

According to the public report, around 20% mortgage borrowers have completed the conversion voluntarily. In the view of Rong360 Jianpu Technology (NYSE: JT) Big Data Institute, there are two major types of misunderstanding when the borrowers make decision on the conversion: First, whether to convert has no impact on the discount of mortgage rate. In fact, whether discounted or higher than the original rate is decided by the added points at conversion. Second, whether to covert has no relation with the future mortgage rate trend. Actually, the future trend of mortgage rate will only have effects on the new housing loans and has nothing to do with the existing mortgage loans. To have these misunderstandings clarified will help individual borrowers to make more appropriate choices based on personal demands.

Di Wang

Jianpu Technology

10 8262 5755

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.