Will 5G Technology Save the Semiconductor Industry in 2020?

Read 5 predictions for the 5G rollout in 2020 and its impacts on the semiconductors industry now.

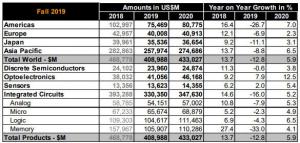

AUSTIN, TEXAS, USA, December 23, 2019 /EINPresswire.com/ -- 2019 ends on a down note for the semiconductor industry, according to the industry trade group WSTS.Worldwide semiconductor sales fell to $409 billion in 2019; that’s down by 12.8% over 2018. Memory device sales, especially DRAM and NAND flash memory, dropped the most (down 33% from the previous year), followed by analog (down 7.9%), and logic devices (down 4.3%).

From the fall 2019 Forecast Meeting, held November 19 to 21, 2019. Image by WSTS

The same industry experts see a reversal of fortune in 2020 — thanks to the rollout of 5G telecommunications networks around the world.

Global semiconductor sales are expected to grow by 5.9% in 2020, led by a resurgent demand for optical and logic devices. Each new generation of wireless networks has helped drive demand for semiconductor products — for inspiration, we just have to look back to 2009 (when the current 4G network rolled out).

But there are some critical differences with this, the fifth generation. We take a look at five ways 5G may be different in 2020 and beyond.

1. Whose 5G Ecosystem Is It Anyway?

For the first time, we’re at the cusp of a major split in the worldwide market for mobile communications networks. The US government acted first, forbidding US companies from doing business with China’s ZTE and later Huawei (and Hisilicon, Huawei’s semiconductor company). The Chinese government has retaliated, banning government purchases of US computers, software, and telecom infrastructure products.

The bottom line? San Diego-based Qualcomm, a world leader in 5G handset chip design, may eventually face a reduced world market share if it stays cut off from the world’s largest market for mobile phones — China. Huawei and other Chinese tech giants (such as Alibaba) have vowed to use “non-USA DNA” chipsets and operating systems, which may put a dent in ARM and Intel-based chip sales, create a new competitor to the world’s most popular phone operating system, Google’s Android, and leave an $11 billion crater in the pocket of American tech companies.

2. Who Will Manufacture The Chips And Network Infrastructure For 5G?

Who will benefit the most from the American vs. Chinese trade dispute?

Some speculate the answer is the Taiwanese semiconductor industry, which may end up producing both “American” and “de-Americanized” semiconductor products.

Other companies, such as Nokia and Ericsson, may also benefit from a 5G ecosystem split, as countries (such as Mexico, Germany, and the UK) weigh the risks of angering Washington by deploying 5G networks based on kit from Huawei.

Thanks to the 5G rollout, demand for Field-Programmable Gate Arrays (FPGAs) should grow – helping both Intel and Xilinx. Also in demand: Ethernet switches and networking equipment (including virtual networking solutions, known as NFV for Network Functions Visualization), which should boost sales from Intel (again) as well as Cisco Systems, Juniper Networks, and Broadcom.

3. The Rollout Strategy For 5G Networks In The USA In 2020

Here in the US, the rollout of 5G telecommunications equipment began in 2019, and it will ramp up into 2020. (This puts us toward the trailing edge of technology, with China and parts of Europe further advanced.)

This time, US-based MNOs (Mobile Network Operators) are desperate to figure out how to leverage their 5G investment, having felt burned by the 4G rollout, which enabled technology platforms, from Amazon to Google, to accrue billions of dollars in stock valuations, while they were the ones who paid for the network.

Vowing never to repeat this mistake, the telcos are looking at some of 5G’s advanced features to identify new ways to slice and dice the network capabilities in order to increase their stock evaluations — and profits. (This wouldn’t have been possible under network neutrality rules, hence the huge lobbying efforts in DC.)

But at the outset, analysts believe the initial rollout will be slow and steady — to conserve cash. Fortunately, according to Deloitte, MNOs did themselves a big favor during the most recent 4.5G investments — much of the fiber and radio gear they installed earlier is 5G ready.

Don’t overlook the opportunities to make your electronic tech labs more efficient and more ergonomic for your personnel. The custom Formaspace furniture, built for a Silicon Valley company, helps increase the productivity of laboratory technicians – each workstation is height adjustable via electronic hydraulics, comes with 20+ outlets, dissipates electrostatic build-up, and offers flexibility long into the future. Indeed many in-the-know customers may find their “5G” phone is really connecting to a late model (call it 4.5G) LTE network, which, while pretty fast, does not offer the truly blistering 5G speeds promised in the promotional materials.

The greatest initial 5G sales push in the US will be for business and consumer FWAs (fixed wireless access devices) — a device with an antenna mounted on the outside of a building to bring 5G connectivity inside.

4. Basestation Challenges And Opportunities That Are Unique To 5G Networks

5G has many advantages for MNOs. For example, 5G transmitters save energy, requiring as little as 1/1000 of the power needed per byte compared to earlier standards. 5G can also transmit data faster, and they offer a much higher capacity for the same bandwidth, helping to drive down the “Megahertz pops” — an industry cost metric that refers to the spectrum license cost of one megahertz of bandwidth passing over one person in the coverage area in a spectrum license.

But the three different bands of spectrum used in 5G make things massively more complicated. Take a simple example, a consumer or business antenna mounted on a building used to connect to the 5G network. Engineers have to design this antenna to pick up Low (sub-1 GHz, such as 700 MHz), Mid (1-6 GHz such an around 3.5-3.8 GHz), and Millimeter-wave (mmWave, such as 28 Ghz) signals.

5G basestations (e.g. the gear connected to cell phone towers) are more complicated as well. To avoid deadspots, multiple transmission towers are used to create a Small Cell Network. Inside, some use Monolithic Microwave Integrated Circuits (MMIC) to speed up data transmission.

To get the highest capacity, some basestations employ what’s known as MIMO (Multiple Input Multiple Output) technology, which streams the data through multiple transmitting and receiving antennas. The extreme case is a Massive MIMO, which can employ several hundred of these antennas simultaneously (compared to a max of 8 in LTE networks).

But wait, there’s more. These antenna signals can’t cross one another (especially at the higher mmWave bandwidths) without degrading the signal. A new “beamforming” technology points each of the data stream signals toward its intended target, creating a more stable signal beam.

Read more ... https://formaspace.com/articles/industrial/will-5g-save-the-semiconductor/?utm_source=einpresswire&utm_medium=content&utm_campaign=article-121819

Mehmet Atesoglu

Formaspace

+5122792792

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.