Mackinac Financial Corporation Reports 2019 Second Quarter Results

MANISTIQUE, Mich., Aug. 01, 2019 (GLOBE NEWSWIRE) -- Mackinac Financial Corporation (Nasdaq: MFNC) (the “Corporation”), the bank holding company for mBank, today announced 2019 second quarter net income of $3.67 million, or $.34 per share, compared to 2018 second quarter net income of $396 thousand, or $.05 per share. The 2018 second quarter results included expenses related to the acquisition of First Federal of Northern Michigan (“FFNM”), which had an after-tax impact of $1.56 million on earnings. Adjusted net income (net of transaction related expenses) for the second quarter of 2018 was $1.96 million or $.25 per share. Second quarter 2019 net income compared to 2018 adjusted net income increased by $1.71 million, or 87%.

Income for the first two quarters of 2019 was $6.84 million, or $.64 per share, compared to $1.93 million, or $.27 per share for the same period of 2018. When giving effect to transaction related expenses, adjusted six-month net income for 2018 was $3.64 million or $.50 per share.

Weighted average shares outstanding for the second quarter 2019 were 10,740,712, compared to 7,769,720 for the same period of 2018. The Corporation issued 2,146,378 new shares for the FFNM purchase in May 2018 and issued an additional 2,225,807 shares related to the common stock offering completed in June 2018.

Total assets of the Corporation at June 2019 were $1.33 billion, compared to $1.27 billion at June 30, 2018. Shareholders’ equity at June 30, 2019 totaled $157.84 million, compared to $148.87 million at June 30, 2018. Book value per share equated to $14.70 at the end of the second quarter 2019, compared to $13.90 per share a year ago. Tangible book value at quarter-end was $133.24 million, or $12.40 per share, compared to $123.97 million, or $11.57 per share at the end of the second quarter 2018.

Additional notes:

- mBank, the Corporation’s primary asset, recorded year-to-date net income of $7.37 million for the first six months of 2019, compared to $3.25 million for the same period of 2018. The 2018 six-month results included expenses related to the acquisition of FFNM, which had an after-tax impact of $1.23 million on earnings. Adjusted bank net income (net of transaction related expenses) for the first half of 2018 was $4.48 million, equating to a year-over-year increase of $2.89 million, or 65%. The increase in net income equated to an improvement in Return on Average Assets at the bank from .63% (.86% as adjusted) for the first six months of 2018 to 1.13% for the same period of 2019.

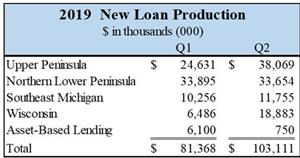

- The Corporation achieved loan growth of $21.84 million through June 30, 2019. As expected, the majority of this growth occurred in the second quarter. The growth was driven by new loan production of $184.5 million in the first half of 2019 comprised of $81.4 million in the first quarter and $103.1 million in the second quarter. New loan production was $59.0 million for the second quarter of 2018 and $103.9 million in the first six months of 2018.

- Total core bank deposits have increased $42.08 million in the first six months of 2019 through more proactive sales activity in the treasury management line of business and increased marketing efforts in key retail markets.

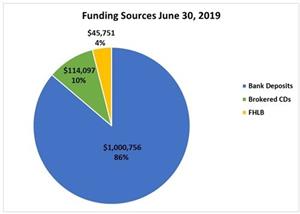

- Reliance on higher-cost brokered deposits continues to decrease significantly from $151.68 million, or 14.94% of total deposits at the end of the second quarter 2018 to $136.76 million, or 12.46% of total deposits at year-end 2018, to a second quarter 2019 balance of $114.10 million, or 10.23% of total deposits.

- Second quarter 2019 net interest margin remained strong at 4.76%. Core operating margin for the second quarter, which is net of accretion from acquired loans that were subject to purchase accounting adjustments and a small amount of interest income recognized from the resolution of some non-accrual loans, was 4.43%.

- The Corporation was added to the Russell 2000 Index in June 2019 when the index finalized its annual reconstitution.

Revenue

Total revenue of the Corporation for second quarter 2019 was $17.87 million, compared to $13.80 million for the second quarter of 2018. Total interest income for the quarter ended June 30, 2019 was $16.76 million, compared to $12.94 million for the same period in 2018. The 2019 second quarter interest income included accretive yield of $740 thousand from credit mark accretion associated with acquisitions and $273 thousand from non-accrual resolution. Credit mark accretion was $284 thousand for the same period of 2018. The year-over-year change in accretive yield was mainly associated with the increase from acquired loan portfolios from the FFNM and Lincoln Community Bank acquisitions.

Loan Production and Portfolio Mix

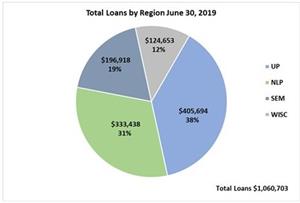

Total balance sheet loans at June 30, 2019 were $1.06 billion, compared to June 30, 2018 balances of $1.00 billion. Total loans under management reside at $1.38 billion, which includes $320.03 million of service retained loans. Loan production for the second quarter of 2019 was $103.1 million, compared to $59.0 million for the second quarter of 2018. Overall loan production for the first six months of 2019 was $184.5 million, compared to $103.9 million in 2018, an increase of $80.6 million, or 77%. Increased production was evident in all lines of business and across the entire market footprint and has driven year-to-date 2019 balance sheet loan growth of $21.84 million.

Overall Quarterly Loan Production: https://www.globenewswire.com/NewsRoom/AttachmentNg/833c3aa5-cb0e-4fc4-877a-9be5362b34a5

2019 New Loan Production: https://www.globenewswire.com/NewsRoom/AttachmentNg/50c70a9f-9a53-4716-9187-e591e26fb2bc

Payoff activity, outside of normal amortization, has been a continual headwind to portfolio growth and was elevated once again in the second quarter of 2019 with $21 million of total commercial credits being paid off ahead of scheduled maturities. Aggregate commercial credits being paid off ahead of maturity totaled $45 million during the first two quarters of 2019.

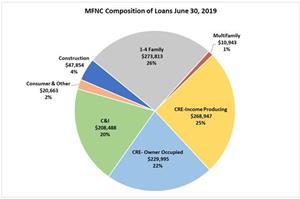

As noted in the charts below, the loan portfolio remains well balanced and diversified in terms of geography and loan type. This prudent diversification should help mitigate both interest rate risk and concentration risk should the current elongated good credit cycle deteriorate as the result of any potential adverse national economic conditions.

Total Loans by Region June 30, 2019: https://www.globenewswire.com/NewsRoom/AttachmentNg/948207e5-c76c-4233-9667-86667430e0f5

MFNC Composition of Loans June 30, 2019: https://www.globenewswire.com/NewsRoom/AttachmentNg/71416a4d-5f94-443e-968c-2c1b91fee222

Commenting on new loan production and overall lending activities, President of the Corporation and President and CEO of mBank, Kelly W. George, stated, “We are very pleased with our first-half 2019 lending activities. Overall new loan production increased again in the second quarter and outpaced last year’s total by $44 million. This production supported our anticipated loan growth for the quarter even with the aforementioned payoff activity. The growing contribution from the new lending teams from the acquisitions last year provided positive impact to these totals and the continued performance from the legacy lending team has been excellent as we continue to adjudicate high quality credits. Secondary market mortgage activity has been significantly augmented by our larger bank platform and 2019 has seen a positive shift in refinance trends for the first time in several years with our refinance volume increasing through the second quarter by 79% over 2018. This trend drove increased year-over-year gain on sale income where premiums remain strong and slightly increased on average from 2018.”

“We continue to monitor payoff activity on the commercial side given the continued competitive pressure for loans from all types of lending organizations. We will stay true to our underwriting and pricing discipline and not stretch to keep credits on the books that could negatively impact our balance sheet in the long-term from either a macro composition or micro individual credit level perspective pending changes in overall economic conditions in our regions.”

Credit Quality

Nonperforming loans totaled $4.70 million, or .44% of total loans at June 30, 2019, compared to $5.0 million, or .50% of total loans at June 30, 2018. Total loan delinquencies greater than 30 days resided at a nominal 1.05 %, compared to .89% in 2018. The nonperforming assets to total assets ratio resided at .51% for second quarter of 2019, compared to .59% for the second quarter of 2018.

The Financial Accounting Standards Board (FASB) recently voted to recommend delaying implementation of the Current Expected Credit Losses methodology (“CECL”) for small public banks, credit unions, and privately held institutions to 2023. MFNC meets the criteria of a small public bank, i.e. a small reporting company described in the FASB vote. If this recommendation holds through the requisite 30-day comment period, the Corporation would not need to implement CECL until 2023.

Commenting on overall credit risk, Mr. George stated, “As expected, we have normalized the slight increase in our non-performing and problem loan credit ratios that occurred in 2018 following the FFNM and Lincoln Community Bank acquisitions. We have seen no signs of any adverse systemic issues in terms of increased payment period times for legacy clients or material deterioration in commercial client financial statements in any of our core industries in which we lend. We also carry a very low level of Other Real Estate Owned, limiting time and expense in resolution of those properties. Purchase accounting marks from the previously acquired banks have continued to prove accurate, attaining expected accretion levels which should continue into future periods.”

Margin Analysis and Funding

Net interest income for the second quarter 2019 was $13.99 million, resulting in a Net Interest Margin (NIM) of 4.76%, compared to $10.81 million in the second quarter 2018 and a NIM of 4.26%. Core operating margin, which is net of accretion from acquired loans that were subject to purchase accounting adjustments and the aforementioned small amount of non-accrual resolution, was 4.43% for the second quarter 2019. Comparatively, net interest income for the first quarter of 2019 resided at $13.24 million, a NIM of 4.55%, and core NIM of 4.37%. As illustrated in the chart below, core NIM remains consistent given the recent flat rate environment and consistent pricing fundamentals of the Corporation.

Margin Analysis Per Quarter: https://www.globenewswire.com/NewsRoom/AttachmentNg/96133c4f-873b-499a-b437-a583e5204f61

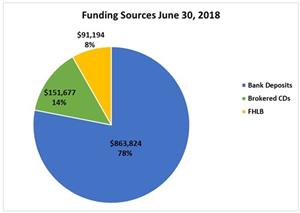

Total bank deposits (excluding brokered deposits) have increased by $136.93 million year-over-year from $863.82 million at June 30, 2018 to $1.00 billion at second quarter-end 2019. Total brokered deposits have decreased significantly and were $114.10 million at June 30, 2019, compared to $151.68 million at June 30, 2018, a decrease of 25%. FHLB (Federal Home Loan Bank) borrowings were also reduced from $91.19 million at the end of the second quarter 2018 to $45.75 million at the end of the second quarter 2019.

Funding Sources June 30, 2019: https://www.globenewswire.com/NewsRoom/AttachmentNg/77cdd581-565c-4cd3-a3f4-368d590069f8

Funding Sources June 30, 2018: https://www.globenewswire.com/NewsRoom/AttachmentNg/a86b7fe0-09f0-41f4-97a7-7902c01898e5

Mr. George stated, “The Corporation’s margin remains consistently strong with continued focus on pricing of both the loan and deposit portfolio. We have also analyzed the potential margin impact if Fed rate cuts continue. Given our well-matched balance sheet, we expect nominal core margin compression as we continue to proactively review traditional bank product offerings and functions to maintain a competitive position with peers, as well as regional and national banks. Our bank deposits are up roughly $40 million since year-end 2018 and have allowed for a continued reduction in higher cost brokered deposits over the course of the first half of 2019. With continued focus and progress, we have significantly lessened our reliance on wholesale funding while maintaining a strong liquidity position to fund loans and our overall operations. Our focus on new core deposit procurement remains a key initiative for 2019 as we look to continue to wind down our wholesale funding sources through aggressive marketing and business development initiatives in our higher volume markets and with our Treasury Management line of business.”

Noninterest Income / Expense

Second quarter 2019 noninterest income was $1.11 million, compared to $863 thousand for the same period of 2018. The year-over-year improvement is a combination of the scale provided by the two 2018 acquisitions as well as continued focus on drivers of noninterest income, including secondary market mortgage and SBA sales. Noninterest expense for the second quarter of 2019 was $10.26 million, compared to $11.08 million for the same period of 2018. The expense variance from 2018 was heavily impacted by the transaction related expenses from FFNM, which equated to $1.98 million on a pre-tax basis. For comparison purposes, noninterest expense remains consistent quarter-over-quarter with the first quarter of 2019 equating to $10.24 million.

Assets and Capital

Total assets of the Corporation at June 30, 2019 were $1.33 billion, compared to $1.27 billion at June 30, 2018. Shareholders’ equity at June 30, 2019 totaled $157.84 million, compared to $148.87 million at June 30, 2018. Book value per share outstanding equated to $14.70 at the end of the second quarter 2019, compared to $13.90 per share outstanding a year ago. Tangible book value at quarter-end was $133.24 million, or $12.40 per share, compared to $123.97 million, or $11.57 per share, at the end of the second quarter 2018. Both the common stock offering and the acquisitions had positive impacts on the Corporation’s overall capitalization and regulatory capital ratios. Each of the Corporation and the Bank are “well-capitalized” with total risk-based capital to risk-weighted assets of 12.72% and 12.74% and tier 1 capital to total tier 1 average assets at the Corporation of 9.74% and at the bank of 9.76%.

Paul D. Tobias, Chairman and Chief Executive Officer of the Corporation and Chairman of mBank concluded, “We believe that the first half of 2019 reflects the positive impact of our 2018 acquisitions and organic growth efforts. We continue to improve efficiency and our core funding with our larger operating platform as we evaluate opportunities for continued growth. We will continue to be receptive to acquisitions with sound economics as we focus on organic growth, credit trends and further operating efficiencies in 2019.”

Mackinac Financial Corporation is a registered bank holding company formed under the Bank Holding Company Act of 1956 with assets in excess of $1.3 billion and whose common stock is traded on the NASDAQ stock market as “MFNC.” The principal subsidiary of the Corporation is mBank. Headquartered in Manistique, Michigan, mBank has 29 branch locations; eleven in the Upper Peninsula, ten in the Northern Lower Peninsula, one in Oakland County, Michigan, and seven in Northern Wisconsin. The Corporation’s banking services include commercial lending and treasury management products and services geared toward small to mid-sized businesses, as well as a full array of personal and business deposit products and consumer loans.

Forward-Looking Statements

This release contains certain forward-looking statements. Words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “should,” “will,” and variations of such words and similar expressions are intended to identify forward-looking statements: as defined by the Private Securities Litigation Reform Act of 1995. These statements reflect management’s current beliefs as to expected outcomes of future events and are not guarantees of future performance. These statements involve certain risks, uncertainties and assumptions that are difficult to predict with regard to timing, extent, likelihood, and degree of occurrence. Therefore, actual results and outcomes may materially differ from what may be expressed or forecasted in such forward-looking statements. Factors that could cause a difference include among others: changes in the national and local economies or market conditions; changes in interest rates and banking regulations; the impact of competition from traditional or new sources; and the possibility that anticipated cost savings and revenue enhancements from mergers and acquisitions, bank consolidations, and other sources may not be fully realized at all or within specified time frames as well as other risks and uncertainties including but not limited to those detailed from time to time in filings of the Corporation with the Securities and Exchange Commission. These and other factors may cause decisions and actual results to differ materially from current expectations. Mackinac Financial Corporation undertakes no obligation to revise, update, or clarify forward-looking statements to reflect events or conditions after the date of this release.

| MACKINAC FINANCIAL CORPORATION AND SUBSIDIARIES SELECTED FINANCIAL HIGHLIGHTS | ||||||||||||||

| As of and For the | As of and For the | As of and For the | ||||||||||||

| Period Ending | Year Ending | Period Ending | ||||||||||||

| June 30, | December 31, | June 30, | ||||||||||||

| (Dollars in thousands, except per share data) | 2019 | 2018 | 2018 | |||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | ||||||||||||

| Selected Financial Condition Data (at end of period): | ||||||||||||||

| Assets | $ | 1,330,723 | $ | 1,318,040 | $ | 1,274,095 | ||||||||

| Loans | 1,060,703 | 1,038,864 | 1,003,377 | |||||||||||

| Investment securities | 110,348 | 116,748 | 114,682 | |||||||||||

| Deposits | 1,114,853 | 1,097,537 | 1,015,501 | |||||||||||

| Borrowings | 46,232 | 60,441 | 91,747 | |||||||||||

| Shareholders' equity | 157,840 | 152,069 | 148,866 | |||||||||||

| Selected Statements of Income Data (six months and year ended) | ||||||||||||||

| Net interest income | $ | 27,233 | $ | 47,130 | $ | 20,122 | ||||||||

| Income before taxes | 8,653 | 10,593 | 2,444 | |||||||||||

| Net income | 6,836 | 8,367 | 1,933 | |||||||||||

| Income per common share - Basic | .64 | .94 | .27 | |||||||||||

| Income per common share - Diluted | .64 | .94 | .27 | |||||||||||

| Weighted average shares outstanding - Basic | 10,730,477 | 8,891,967 | 7,041,010 | |||||||||||

| Weighted average shares outstanding- Diluted | 10,739,471 | 8,921,658 | 7,073,764 | |||||||||||

| Three Months Ended: | ||||||||||||||

| Net interest income | $ | 13,997 | $ | 13,495 | $ | 10,813 | ||||||||

| Income before taxes | 4,644 | 4,260 | 499 | |||||||||||

| Net income | 3,669 | 3,365 | 396 | |||||||||||

| Income per common share - Basic | .34 | .31 | .05 | |||||||||||

| Income per common share - Diluted | .34 | .31 | .05 | |||||||||||

| Weighted average shares outstanding - Basic | 10,740,712 | 10,712,745 | 7,769,720 | |||||||||||

| Weighted average shares outstanding- Diluted | 10,752,070 | 10,712,745 | 7,809,018 | |||||||||||

| Selected Financial Ratios and Other Data: | ||||||||||||||

| Performance Ratios: | ||||||||||||||

| Net interest margin | 4.65 | % | 4.44 | % | 4.23 | % | ||||||||

| Efficiency ratio | 68.94 | 77.70 | 87.27 | |||||||||||

| Return on average assets | 1.04 | .71 | .37 | |||||||||||

| Return on average equity | 8.89 | 6.94 | 4.27 | |||||||||||

| Average total assets | $ | 1,323,321 | $ | 1,177,455 | $ | 1,050,305 | ||||||||

| Average total shareholders' equity | 155,098 | 120,478 | 91,258 | |||||||||||

| Average loans to average deposits ratio | 95.22 | % | 97.75 | % | 99.89 | % | ||||||||

| Common Share Data at end of period: | ||||||||||||||

| Market price per common share | $ | 15.80 | $ | 13.65 | $ | 16.58 | ||||||||

| Book value per common share | 14.70 | 14.20 | 13.90 | |||||||||||

| Tangible book value per share | 12.40 | 11.61 | 11.57 | |||||||||||

| Dividends paid per share, annualized | .480 | .480 | .480 | |||||||||||

| Common shares outstanding | 10,740,712 | 10,712,745 | 10,712,745 | |||||||||||

| Other Data at end of period: | ||||||||||||||

| Allowance for loan losses | $ | 5,306 | $ | 5,183 | $ | 5,141 | ||||||||

| Non-performing assets | $ | 6,798 | $ | 8,196 | $ | 7,486 | ||||||||

| Allowance for loan losses to total loans | .50 | % | .50 | % | .51 | % | ||||||||

| Non-performing assets to total assets | .51 | % | .62 | % | .59 | % | ||||||||

| Texas ratio | 4.91 | % | 6.33 | % | 5.80 | % | ||||||||

| Number of: | ||||||||||||||

| Branch locations | 29 | 29 | 29 | |||||||||||

| FTE Employees | 301 | 288 | 233 | |||||||||||

|

MACKINAC FINANCIAL CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS | |||||||||||||

| June 30, | December 31, | June 30, | |||||||||||

| 2019 | 2018 | 2018 | |||||||||||

| (Unaudited) | (Unaudited) | ||||||||||||

| ASSETS | |||||||||||||

| Cash and due from banks | $ | 60,680 | $ | 64,151 | $ | 64,874 | |||||||

| Federal funds sold | 10 | 6 | 15 | ||||||||||

| Cash and cash equivalents | 60,690 | 64,157 | 64,889 | ||||||||||

| Interest-bearing deposits in other financial institutions | 12,465 | 13,452 | 10,873 | ||||||||||

| Securities available for sale | 110,348 | 116,748 | 114,682 | ||||||||||

| Federal Home Loan Bank stock | 4,924 | 4,924 | 4,860 | ||||||||||

| Loans: | |||||||||||||

| Commercial | 755,176 | 717,032 | 684,725 | ||||||||||

| Mortgage | 284,864 | 301,461 | 299,450 | ||||||||||

| Consumer | 20,663 | 20,371 | 19,202 | ||||||||||

| Total Loans | 1,060,703 | 1,038,864 | 1,003,377 | ||||||||||

| Allowance for loan losses | (5,306 | ) | (5,183 | ) | (5,141 | ) | |||||||

| Net loans | 1,055,397 | 1,033,681 | 998,236 | ||||||||||

| Premises and equipment | 23,166 | 22,783 | 21,790 | ||||||||||

| Other real estate held for sale | 2,125 | 3,119 | 2,461 | ||||||||||

| Deferred tax asset | 6,259 | 5,763 | 8,000 | ||||||||||

| Deposit based intangibles | 5,380 | 5,720 | 4,504 | ||||||||||

| Goodwill | 19,224 | 22,024 | 20,389 | ||||||||||

| Other assets | 30,745 | 25,669 | 23,411 | ||||||||||

| TOTAL ASSETS | $ | 1,330,723 | $ | 1,318,040 | $ | 1,274,095 | |||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||||||||

| LIABILITIES: | |||||||||||||

| Deposits: | |||||||||||||

| Noninterest bearing deposits | $ | 276,776 | $ | 241,556 | $ | 220,176 | |||||||

| NOW, money market, interest checking | 344,213 | 368,890 | 337,344 | ||||||||||

| Savings | 111,438 | 111,358 | 106,022 | ||||||||||

| CDs<$250,000 | 256,689 | 225,236 | 181,352 | ||||||||||

| CDs>$250,000 | 11,640 | 13,737 | 18,930 | ||||||||||

| Brokered | 114,097 | 136,760 | 151,677 | ||||||||||

| Total deposits | 1,114,853 | 1,097,537 | 1,015,501 | ||||||||||

| Federal funds purchased | — | 2,905 | 10,000 | ||||||||||

| Borrowings | 46,232 | 57,536 | 91,747 | ||||||||||

| Other liabilities | 11,798 | 7,993 | 7,980 | ||||||||||

| Total liabilities | 1,172,883 | 1,165,971 | 1,125,228 | ||||||||||

| SHAREHOLDERS’ EQUITY: | |||||||||||||

| Common stock and additional paid in capital - No par value Authorized - 18,000,000 shares Issued and outstanding - 10,740,712; 10,712,745 and 10,712,745 respectively | 129,262 | 129,066 | 128,880 | ||||||||||

| Retained earnings | 27,734 | 23,466 | 19,602 | ||||||||||

| Accumulated other comprehensive income (loss) | |||||||||||||

| Unrealized (losses) gains on available for sale securities | 1,062 | (245 | ) | 606 | |||||||||

| Minimum pension liability | (218 | ) | (218 | ) | (221 | ) | |||||||

| Total shareholders’ equity | 157,840 | 152,069 | 148,867 | ||||||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 1,330,723 | $ | 1,318,040 | $ | 1,274,095 | |||||||

|

MACKINAC FINANCIAL CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS | ||||||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||

| June 30, | June 30, | |||||||||||||

| 2019 | 2018 | 2019 | 2018 | |||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||

| INTEREST INCOME: | ||||||||||||||

| Interest and fees on loans: | ||||||||||||||

| Taxable | $ | 15,586 | $ | 12,071 | $ | 30,181 | $ | 22,461 | ||||||

| Tax-exempt | 42 | 31 | 89 | 56 | ||||||||||

| Interest on securities: | ||||||||||||||

| Taxable | 680 | 560 | 1,383 | 932 | ||||||||||

| Tax-exempt | 85 | 79 | 183 | 148 | ||||||||||

| Other interest income | 367 | 197 | 752 | 396 | ||||||||||

| Total interest income | 16,760 | 12,938 | 32,588 | 23,993 | ||||||||||

| INTEREST EXPENSE: | ||||||||||||||

| Deposits | 2,515 | 1,602 | 4,869 | 2,838 | ||||||||||

| Borrowings | 248 | 523 | 486 | 1,033 | ||||||||||

| Total interest expense | 2,763 | 2,125 | 5,355 | 3,871 | ||||||||||

| Net interest income | 13,997 | 10,813 | 27,233 | 20,122 | ||||||||||

| Provision for loan losses | 200 | 100 | 300 | 150 | ||||||||||

| Net interest income after provision for loan losses | 13,797 | 10,713 | 26,933 | 19,972 | ||||||||||

| OTHER INCOME: | ||||||||||||||

| Deposit service fees | 408 | 323 | 814 | 592 | ||||||||||

| Income from loans sold on the secondary market | 355 | 277 | 667 | 454 | ||||||||||

| SBA/USDA loan sale gains | 29 | 83 | 154 | 134 | ||||||||||

| Mortgage servicing amortization | 128 | (2 | ) | 248 | (10 | ) | ||||||||

| Other | 190 | 182 | 344 | 307 | ||||||||||

| Total other income | 1,110 | 863 | 2,227 | 1,477 | ||||||||||

| OTHER EXPENSE: | ||||||||||||||

| Salaries and employee benefits | 5,511 | 4,923 | 10,946 | 9,077 | ||||||||||

| Occupancy | 1,004 | 928 | 2,085 | 1,739 | ||||||||||

| Furniture and equipment | 723 | 644 | 1,441 | 1,175 | ||||||||||

| Data processing | 708 | 586 | 1,417 | 1,090 | ||||||||||

| Advertising | 214 | 192 | 523 | 387 | ||||||||||

| Professional service fees | 547 | 397 | 981 | 701 | ||||||||||

| Loan origination expenses and deposit and card related fees | 184 | 148 | 363 | 274 | ||||||||||

| Writedowns and losses on other real estate held for sale | 73 | 40 | 101 | 66 | ||||||||||

| FDIC insurance assessment | 77 | 187 | 211 | 343 | ||||||||||

| Communications expense | 232 | 152 | 460 | 307 | ||||||||||

| Transaction related expenses | - | 1,976 | - | 2,165 | ||||||||||

| Other | 990 | 904 | 1,979 | 1,681 | ||||||||||

| Total other expenses | 10,263 | 11,077 | 20,507 | 19,005 | ||||||||||

| Income before provision for income taxes | 4,644 | 499 | 8,653 | 2,444 | ||||||||||

| Provision for income taxes | 975 | 103 | 1,817 | 511 | ||||||||||

| NET INCOME AVAILABLE TO COMMON SHAREHOLDERS | $ | 3,669 | $ | 396 | $ | 6,836 | $ | 1,933 | ||||||

| INCOME PER COMMON SHARE: | ||||||||||||||

| Basic | $ | .34 | $ | .05 | $ | .64 | $ | .27 | ||||||

| Diluted | $ | .34 | $ | .05 | $ | .64 | $ | .27 | ||||||

|

MACKINAC FINANCIAL CORPORATION AND SUBSIDIARIES LOAN PORTFOLIO AND CREDIT QUALITY | |||||||||

| (Dollars in thousands) | |||||||||

| Loan Portfolio Balances (at end of period): | |||||||||

| June 30, | December 31, | June 30, | |||||||

| 2019 | 2018 | 2018 | |||||||

| (Unaudited) | (Unaudited) | (Unaudited) | |||||||

| Commercial Loans: | |||||||||

| Real estate - operators of nonresidential buildings | $ | 143,897 | $ | 150,251 | $ | 117,285 | |||

| Hospitality and tourism | 92,809 | 77,598 | 78,122 | ||||||

| Lessors of residential buildings | 49,489 | 50,204 | 37,866 | ||||||

| Gasoline stations and convenience stores | 26,974 | 24,189 | 22,207 | ||||||

| Logging | 21,666 | 20,860 | 17,368 | ||||||

| Commercial construction | 36,803 | 29,765 | 20,895 | ||||||

| Other | 383,538 | 364,165 | 390,982 | ||||||

| Total Commercial Loans | 755,176 | 717,032 | 684,725 | ||||||

| 1-4 family residential real estate | 273,813 | 286,908 | 284,041 | ||||||

| Consumer | 20,663 | 20,371 | 19,202 | ||||||

| Consumer construction | 11,051 | 14,553 | 15,409 | ||||||

| Total Loans | $ | 1,060,703 | $ | 1,038,864 | $ | 1,003,377 | |||

| Credit Quality (at end of period): | |||||||||

| June 30, | December 31, | June 30, | |||||||

| 2019 | 2018 | 2018 | |||||||

| (Unaudited) | (Unaudited) | (Unaudited) | |||||||

| Nonperforming Assets : | |||||||||

| Nonaccrual loans | $ | 4,673 | $ | 5,054 | $ | 3,825 | |||

| Loans past due 90 days or more | - | 23 | - | ||||||

| Restructured loans | - | - | 1,200 | ||||||

| Total nonperforming loans | 4,673 | 5,077 | 5,025 | ||||||

| Other real estate owned | 2,125 | 3,119 | 2,461 | ||||||

| Total nonperforming assets | $ | 6,798 | $ | 8,196 | $ | 7,486 | |||

| Nonperforming loans as a % of loans | .44 | % | .49 | % | .50 | % | |||

| Nonperforming assets as a % of assets | .51 | % | .62 | % | .59 | % | |||

| Reserve for Loan Losses: | |||||||||

| At period end | $ | 5,306 | $ | 5,183 | $ | 5,141 | |||

| As a % of average loans | .50 | % | .50 | % | .51 | % | |||

| As a % of nonperforming loans | 113.55 | % | 102.09 | % | 102.31 | % | |||

| As a % of nonaccrual loans | 113.55 | % | 102.55 | % | 134.41 | % | |||

| Texas Ratio | 4.91 | % | 6.33 | % | 5.80 | % | |||

| Charge-off Information (year to date): | |||||||||

| Average loans | $ | 1,049,383 | $ | 941,221 | $ | 858,508 | |||

| Net charge-offs (recoveries) | $ | 177 | $ | 396 | $ | 88 | |||

| Charge-offs as a % of average loans, annualized | .03 | % | .04 | % | .02 | % | |||

|

MACKINAC FINANCIAL CORPORATION AND SUBSIDIARIES QUARTERLY FINANCIAL HIGHLIGHTS | |||||||||||||||||||||

| QUARTER ENDED | |||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||

| June 30, | March 31, | December 31 | September 30, | June 30 | |||||||||||||||||

| 2019 | 2019 | 2018 | 2018 | 2018 | |||||||||||||||||

| BALANCE SHEET (Dollars in thousands) | |||||||||||||||||||||

| Total loans | $ | 1,060,703 | $ | 1,045,428 | $ | 1,038,864 | $ | 993,808 | $ | 1,003,377 | |||||||||||

| Allowance for loan losses | (5,306 | ) | (5,154 | ) | (5,183 | ) | (5,186 | ) | (5,141 | ) | |||||||||||

| Total loans, net | 1,055,397 | 1,040,274 | 1,033,681 | 988,622 | 998,236 | ||||||||||||||||

| Total assets | 1,330,723 | 1,316,996 | 1,318,040 | 1,254,335 | 1,274,095 | ||||||||||||||||

| Core deposits | 989,116 | 965,359 | 947,040 | 885,988 | 844,894 | ||||||||||||||||

| Noncore deposits | 125,737 | 131,889 | 150,497 | 142,070 | 170,607 | ||||||||||||||||

| Total deposits | 1,114,853 | 1,097,248 | 1,097,537 | 1,028,058 | 1,015,501 | ||||||||||||||||

| Total borrowings | 46,232 | 53,678 | 60,441 | 69,216 | 91,747 | ||||||||||||||||

| Total shareholders' equity | 157,840 | 154,746 | 152,069 | 149,367 | 148,867 | ||||||||||||||||

| Total tangible equity | 133,236 | 129,973 | 124,325 | 124,605 | 123,974 | ||||||||||||||||

| Total shares outstanding | 10,740,712 | 10,740,712 | 10,712,745 | 10,712,745 | 10,712,745 | ||||||||||||||||

| Weighted average shares outstanding | 10,752,070 | 10,720,127 | 10,712,745 | 10,712,745 | 7,769,720 | ||||||||||||||||

| AVERAGE BALANCES (Dollars in thousands) | |||||||||||||||||||||

| Assets | $ | 1,326,827 | $ | 1,320,080 | $ | 1,320,996 | $ | 1,284,068 | $ | 1,117,188 | |||||||||||

| Loans | 1,051,998 | 1,046,740 | 1,043,409 | 1,001,763 | 905,802 | ||||||||||||||||

| Deposits | 1,103,413 | 1,099,644 | 1,087,174 | 1,042,004 | 913,220 | ||||||||||||||||

| Equity | 156,491 | 153,689 | 149,241 | 149,202 | 100,518 | ||||||||||||||||

| INCOME STATEMENT (Dollars in thousands) | |||||||||||||||||||||

| Net interest income | $ | 13,997 | $ | 13,236 | $ | 13,795 | $ | 13,214 | $ | 10,813 | |||||||||||

| Provision for loan losses | 200 | 100 | 300 | 50 | 100 | ||||||||||||||||

| Net interest income after provision | 13,797 | 13,136 | 13,495 | 13,164 | 10,713 | ||||||||||||||||

| Total noninterest income | 1,110 | 1,117 | 1,443 | 1,343 | 863 | ||||||||||||||||

| Total noninterest expense | 10,263 | 10,244 | 10,678 | 10,618 | 11,077 | ||||||||||||||||

| Income before taxes | 4,644 | 4,009 | 4,260 | 3,889 | 499 | ||||||||||||||||

| Provision for income taxes | 975 | 842 | 895 | 820 | 103 | ||||||||||||||||

| Net income available to common shareholders | $ | 3,669 | $ | 3,167 | $ | 3,365 | $ | 3,069 | $ | 396 | |||||||||||

| Income pre-tax, pre-provision | $ | 4,844 | $ | 4,109 | $ | 4,560 | $ | 3,939 | $ | 599 | |||||||||||

| PER SHARE DATA | |||||||||||||||||||||

| Earnings per common share | $ | .34 | $ | .30 | $ | .31 | $ | .29 | $ | .05 | |||||||||||

| Book value per common share | 14.70 | 14.41 | 14.20 | 13.94 | 13.90 | ||||||||||||||||

| Tangible book value per share | 12.40 | 12.10 | 11.61 | 11.63 | 11.57 | ||||||||||||||||

| Market value, closing price | 15.80 | 15.74 | 13.65 | 16.20 | 16.58 | ||||||||||||||||

| Dividends per share | .120 | .120 | .120 | .120 | .120 | ||||||||||||||||

| ASSET QUALITY RATIOS | |||||||||||||||||||||

| Nonperforming loans/total loans | .44 | % | .53 | % | .49 | % | .46 | % | .50 | % | |||||||||||

| Nonperforming assets/total assets | .51 | .57 | .62 | .53 | .59 | ||||||||||||||||

| Allowance for loan losses/total loans | .50 | .49 | .50 | .52 | .51 | ||||||||||||||||

| Allowance for loan losses/nonperforming loans | 113.55 | 92.23 | 102.09 | 114.58 | 102.31 | ||||||||||||||||

| Texas ratio | 4.91 | 5.59 | 6.33 | 5.14 | 5.80 | ||||||||||||||||

| PROFITABILITY RATIOS | |||||||||||||||||||||

| Return on average assets | 1.11 | % | .97 | % | 1.01 | % | .95 | % | .14 | % | |||||||||||

| Return on average equity | 9.40 | 8.36 | 8.95 | 8.16 | 1.58 | ||||||||||||||||

| Net interest margin | 4.76 | 4.55 | 4.64 | 4.60 | 4.26 | ||||||||||||||||

| Average loans/average deposits | 95.34 | 95.10 | 95.97 | 96.14 | 99.19 | ||||||||||||||||

| CAPITAL ADEQUACY RATIOS | |||||||||||||||||||||

| Tier 1 leverage ratio | 9.74 | % | 9.54 | % | 9.24 | % | 9.51 | % | 9.39 | % | |||||||||||

| Tier 1 capital to risk weighted assets | 12.20 | 12.28 | 11.95 | 12.62 | 11.87 | ||||||||||||||||

| Total capital to risk weighted assets | 12.72 | 12.79 | 12.47 | 13.17 | 12.39 | ||||||||||||||||

| Average equity/average assets (for the quarter) | 11.80 | 11.64 | 11.30 | 11.62 | 9.00 | ||||||||||||||||

| Tangible equity/tangible assets (at quarter end) | 10.20 | 10.06 | 9.64 | 10.13 | 9.92 | ||||||||||||||||

Contact: Jesse A. Deering, EVP & Chief Financial Officer (248) 290-5906 /jdeering@bankmbank.com

Website: www.bankmbank.com

Overall Quarterly Loan Production

Overall Quarterly Loan Production

2019 New Loan Production

2019 New Loan Production

Total Loans by Region June 30, 2019

Total Loans by Region June 30, 2019

MFNC Composition of Loans June 30, 2019

MFNC Composition of Loans June 30, 2019

Margin Analysis Per Quarter

Margin Analysis Per Quarter

Funding Sources June 30, 2019

Funding Sources June 30, 2019

Funding Sources June 30, 2018

Funding Sources June 30, 2018

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.