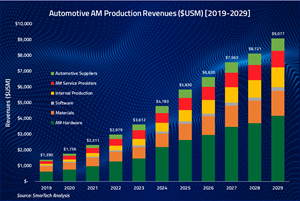

SmarTech Analysis Issues New Report on Automotive Additive Manufacturing Market, Sees a $9 Billion ($USD) Opportunity on the Horizon

CROZET, Va., Aug. 01, 2019 (GLOBE NEWSWIRE) -- SmarTech Analysis, the leading provider of industry analysis and market forecasting data to the additive manufacturing industry, has released its fourth annual market study of additive manufacturing in the automotive sector. In the report the firm reports increasing adoption of AM technologies by key automakers, automotive parts suppliers and AM services catering to the automotive segment will result in an overall $9 billion opportunity by 2029, including an over 4 billion yearly revenue opportunity from AM applications in tools and final parts production.

Details of the report including a table of contents and sample can be found at https://www.smartechanalysis.com/reports/additive-manufacturing-automotive-part-production-2019/

From the Report:

- The transitional shifts from 3D printing for prototyping to 3D printing production – and from traditional, formative (analogue) manufacturing to digital additive manufacturing – are not as streamlined as was initially envisioned. As the technology evolves, it becomes increasingly clear that addressing the specific final part production requirements of adopting industrial segments is a task that is several orders of magnitude greater than the production of functional prototypes. Thus, the investments required are also several orders of magnitude greater. These larger investments are driven and—SmarTech expects—will continue to be driven by potential rewards, in terms of business opportunities, that are several orders of magnitude greater than those deriving from limiting the scope of additive manufacturing to its current use in prototyping.

- SmarTech Analysis expects that, as the overall automotive parts and accessories segment grows into a $460-billion market by 2025, and could thus near $500 billion by 2029, the AM opportunity is expected to grow into an overall $9 billion business.

- New AM systems and technologies, which have just begun to enter commercial availability, are now increasingly able to provide larger parts, larger part batches and faster production capabilities (both via hardware evolution and increased process automation), along with more readily available end-use materials. As SmarTech Analysis forecasted a year ago, the current period is of fundamental importance for defining AM adoption by the automotive segment.

- Although Europe currently leads in metal AM and the Americas lead in polymer AM adoption, China is expected to generate the most revenues in automotive AM in terms of cumulative revenues throughout the forecast period. The United States is the second largest market and Germany is the third, each dominating their respective geographic areas.

- The average price of metal systems—which is currently very high and approaching $500,000—is expected to decrease significantly over the course of the forecast period due to widespread adoption of affordably priced bound metal filament systems. These systems currently have an average cost of about $75,000 and are expected to gradually decrease to about $50,000 by the end of the forecast period.

- Adoption of polymer AM in automotive manufacturing is focusing on certain materials specifically; nylon (mainly PA12 but also various other PA grades) and ABS are expected to continue to enjoy widespread adoption—especially in composite variants integrating carbon fiber (for lightweight and strength) or glass fiber for high temperature resistance. SmarTech is also seeing increased adoption of elastomers such as TPU (thermoplastic polyurethane) and PP (polypropylene).

- In metals, much of the focus in automotive remains on steel, the most widely used metal both in automotive and AM, as well as on titanium for high end automotive applications, mainly in motor sports or one-off and short batch production runs. For the future aluminum—which is widely used for prototyping today—is seen as a key material for lightweight, more affordable end use part production both through metal PBF and—possibly—by binder jetting processes.

About SmarTech Analysis:

Since 2013 SmarTech Analysis has published reports on all the important revenue opportunities in the 3D printing/additive manufacturing sector and is considered the leading industry analyst firm providing coverage of this sector. Our company has a client roster that includes the largest 3D printer firms, materials firms and investors in the 3DP/AM sector.

For more details on our company go to www.smartechanalysis.com

Contact:

Robert Nolan

(804) 938-0030

rob@smartechpublishing.com

An image accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/de0b1c7c-c5e9-4ac1-967e-253489a580ba

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.