DIAGNOS Inc. issued upside market valuation in research report

Adoption curve expected to continue to accelerate for proprietary technology applying artificial intelligence in healthcare diabetes market.

DIAGNOS Inc. (TSX:ADK)

NEW YORK, NY, UNITED STATES, June 1, 2017 /EINPresswire.com/ -- DIAGNOS Inc. (TSX VENTURE: ADK) (OTC: DGNOF) (Frankfurt: 4D4) is identified in a newly issued research report by Market Equities Research Group with several potential catalysts that exist near-term with potential to result in $150 million market cap ($1 /share) for TSX-V: ADK. DIAGNOS Inc. is successfully continuing its transition from R&D to commercialization of the CARA disruptive technology:

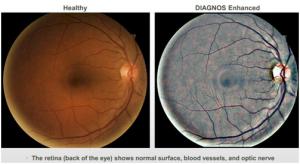

- Computer Assisted Retinal Analysis (CARA) is a web-based software application that integrates a proprietary image processing technology with fundus cameras which is revolutionizing retinal scanning for a number of serious health conditions, including Diabetic Retinopathy (now) and cardiac conditions (future).

- CARA has been in development since 2005 – early success led to a formal team being assembled in 2009, followed by ISO certification in 2010, FDA approval in 2011 and CE (Europe) approval in 2012. Numerous studies and field trials have vetted CARA as a leading, market-ready solution, with the company now active with full commercialization efforts. The company is now active in 15 countries.

- The available market for Diabetic Retinopathy scanning is very large, with annual scanning recommended for over 400million diabetics worldwide – existing systems using manual interpretation by specialists cannot cope – CARA automates the process – at the local (doctor office) level, a systemic change.

- Longer term, even larger blue sky potential is available should DIAGNOS ‘crack the code’ to using its retina scanning platform to conduct early stage diagnosis for heart disease.

The full research report may be found at http://sectornewswire.com/MarketEquitiesResearch-ADK-June-2017.pdf online.

Several Potential Value Catalysts in 2017 / 2018, Potential $150M+ market cap, $1+/share:

- Large, worldwide market.

- Proven technology, endorsed by major pharma.

- First mover advantage, well positioned in 15 counties (and quickly growing).

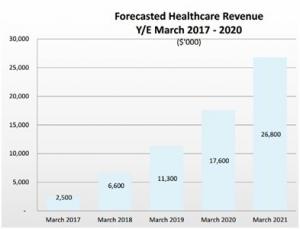

REVENUE POTENTIAL

Shorter term, the FY forecast is predicated on DIAGNOS Inc. continued success in Mexico (i.e. 2/3 of FY 2018 revenue), combined with ongoing testing in several other countries. Beyond that, expectations are based on CARA gaining additional traction in one or more markets where management is active currently with prospects and proposals.

Click page 13 of research report located at http://sectornewswire.com/MarketEquitiesResearch-ADK-June-2017.pdf online for image/table of Company’s forecasted healthcare revenue; (Source: Company disclosures) NOTE: The Company has an established history of being conservative and exceeding forecasts. Forecasts are based on known events & conservative assumptions -- any number of catalysts have the potential to dwarf the above figures, and likely will.

At this stage, however, in light of all the considerations mentioned previously, the story for DIAGNOS Inc. is not necessarily a quarter to quarter revenue story, nor is it about annual results year over year. The real story is a fundamental analysis regarding the ultimate adoption of large-scale medical systems of automated retinal screening – we believe such adoption is basically inevitable.

The question then becomes to what extent DIAGNOS Inc. will participate in this revolution. From our perspective, what we see is an early and successful advancement of CARA, ISO certifications, regulatory approvals, partnerships with major pharma companies, and a presence in an increasing number of countries. Given the worldwide nature of the problem and DIAGNOS Inc. worldwide focus, we believe that the company is well positioned going forward, and the market for CARA appears to be approaching an inflection point, perhaps in 2017 and if not over this timeframe, in 2018.

Longer term, CARA as a platform technology that has potential to revolutionize scanning and diagnosis for large scale health care issues, there is little doubt that true blue sky exists.

SUMMARY & CONCLUSION

We view DIAGNOS’ CARA technology as a leading edge retinal diagnostic platform. It is know that it is leading edge in its field and has been tested extensively in over 15 countries. It is endorsed by top 10 pharma companies and appears to be gaining traction.

The issue is that as a disruptive technology, it takes time for large scale medical systems to make major changes in how it approaches a large scale problem, such as diabetes. We believe that manual scanning, given the issues involved combined with the accuracy and cost of automated scanning, will ultimately become a thing of the past. We believe that DIAGNOS Inc. is very well positioned to take advantage of this. The question is not so much if, but when. Management and sales staff are dedicated to making this happen.

Our current 12-month $1/share price target for TSX-V:ADK is based principally on DIAGNOS Inc.’s own corporate forecasts bearing out for its CARA platform alone, ignoring additional upside from the apparent likelihood and high probability of new business from big-Pharma, governments, hospitals, and clinics world-wide developing. Acceleration of the adoption curve for DIAGNOS’ technology is likely to continue and will further warrant upside revaluation, above $1/share as it materializes. As the business grows, the longer-term strategy for the Company is to eventually shift more toward standalone deployment of its technology, with others/partners carrying the operating costs, and DIAGNOS acting as a centralized world-wide cloud-based database/processing center (The Company has a secure state-of-the-art facility in Montreal where its software enhances and analyzes retinal images of patients) handling ever larger volumes of transactions, further benefiting from higher related margins and economies of scale.

Over the longer-term, there seems little doubt that as systems improve and more resources are devoted to it, retinal scanning will ultimately provide far reaching benefits for the scanning for a number of conditions, including heart disease. DIAGNOS Inc. is working on this, and if it can become a central player in this field, the financial potential for the company is enormous. Any news regarding developments of DIAGNOS’ AI technology in the heart disease sector have the potential to catapult the Company share price well beyond our $1/share 12-month target as the size of the heart disease sector is on an order of magnitude dramatically larger than diabetes and would accelerate the Company towards imminent take-over target status.

The above is for information purposes only and is not a solicitation to buy or sell any of the securities mentioned.

Fredrick William

Market Equities Research Group

8666209945

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.