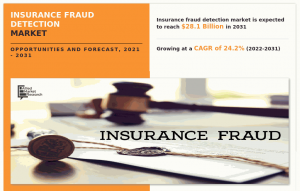

Insurance Fraud Detection Market Expected to Reach $28.1 Billion by 2031 with a Strong 24.2% CAGR: BAE Systems

Insurance Fraud Detection Market Expected to Reach $28.1 Billion by 2031 with a Strong 24.2% CAGR: BAE Systems

NEW CASTLE, DELAWARE, UNITED STATES, July 4, 2024 /EINPresswire.com/ -- Allied Market Research recently published a report, titled, "Insurance Fraud Detection Market1 by Component (Solution, Services), by Deployment Mode (On-premises, Cloud), by Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), by Applications (Payment Fraud and Billing Fraud, Identity Theft, Claims Fraud, Money Laundering): Global Opportunity Analysis and Industry Forecast, 2021-2031." According to the report, the global insurance fraud detection industry generated $3.3 billion in 2021, and is expected to reach $28.1 billion by 2031, witnessing a CAGR of 24.2% from 2022 to 2031.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/7313

Insurance frauds cover the range of improper activities which an individual may commit in order to achieve a favorable outcome from the insurance company. This could range from staging the incident, misrepresenting the situation including the relevant actors and the cause of incident and finally the extent of damage caused. Insurance fraud detection is a challenging problem, given the variety of fraud patterns and relatively small ratio of known frauds in typical samples. While building detection models, the savings from loss prevention needs to be balanced with cost of false alerts. Machine learning techniques allow for improving predictive accuracy, enabling loss control units to achieve higher coverage with low false positive rates.

Drivers, Restraints, and Opportunities

Rise in use of advanced analytics & technologies for determining fake medical records, inaccurate claims, abductions, and others along with improvements in cyber security infrastructure drive the growth of the global insurance fraud detection market. However, improper handling of data and privacy issues limit the market growth. On the other hand, surge in adoption of advanced technologies such as artificial intelligence and machine learning for detecting fraud in insurance claims creates new opportunities in the coming years.

Covid-19 Scenario

The Covid-19 pandemic raised the claims of insurances across the globe in different sectors, specifically in the healthcare sector due to surge in number of hospitalizations of infected patients.

With the rise in number of claims related to healthcare, the fraudulent claims surged substantially. Insurance providers are adopting advanced technologies and utilizing data to detect fraudulent claims and tackle losses. Moreover, they carried out cross-industry anti-fraud collaborations to protect honest customers.

Many insurance companies underwent the digital transformation programs to detect sophisticated and evolving fraudulent insurance claim behaviors.

The Solution Segment to Maintain Its Lead Status Throughout the Forecast Period

Based on component, the solution segment accounted for the highest market share in 2021, contributing to nearly three-fourths of the global insurance fraud detection market, and is estimated to maintain its lead status throughout the forecast period. This is attributed to rise in instances of inaccurate claims, abductions, deaths, and fake medical records along with the integration of insurance fraud detection solutions with the internet of things (IoT) and artificial intelligence (AI). However, the services segment is expected to manifest the fastest CAGR of 27.8% from 2022 to 2031, owing to offering of professional & managed services including consulting, support & maintenance, and training services that are designed for consumers to mitigate fraud risks.

➡️𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠: https://www.alliedmarketresearch.com/purchase-enquiry/7313

The Payment Fraud and Billing Fraud Segment to Maintain Its Leadership Status By 2031

Based on application, the payment fraud and billing fraud segment held the highest share in 2021, accounting for nearly two-fifths of the global insurance fraud detection market, and is projected to maintain its leadership status by 2031. This is due to surge in insurance fraud detection software for payment and billing fraud detection and adoption of standard rule-based anti-fraud system offered by banks and institutions. However, the claims fraud segment is projected to witness the highest CAGR of 26.8% from 2022 to 2031. This is owing to implementation of machine learning and AI-based algorithms and solutions by insurers to process claims quickly and efficiently.

Asia-Pacific to Continue Its Lead Position by 2031

Based on region, Asia-Pacific contributed to the highest market share in terms of revenue in 2021, accounting for more than one-third of the global market, and is projected to continue its lead position by 2031. This is attributed to the trend of modernization & digitalization, investments in digital tools & solutions and hybrid agency models, and adoption of advanced technologies such as AI and big data analytics. However, North America is estimated to witness the largest CAGR of 26.6% during the forecast period. This is due to rise in the demand for disability insurance services, increase in adoption of digital advisor tools, investments in analytics capabilities and claims automation. In addition, market players in this region are offering pay-as-you-go product & solutions and forming new partnerships and collaborations.

➡️𝐈𝐟 𝐲𝐨𝐮 𝐡𝐚𝐯𝐞 𝐚𝐧𝐲 𝐬𝐩𝐞𝐜𝐢𝐚𝐥 𝐫𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭𝐬, 𝐫𝐞𝐪𝐮𝐞𝐬𝐭 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧@ https://www.alliedmarketresearch.com/request-for-customization/7313?reqfor=covid

Leading Market Players

BAE Systems

Duck Creek Technologies

Equifax Inc.

Experian Information Solutions, Inc.

FICO

FRISS

Fiserv, Inc.

IBM

LexisNexis Risk Solutions Group.

SAS Institute Inc.

Key benefits for stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the insurance fraud detection market forecast from 2021 to 2031 to identify the prevailing insurance fraud detection market opportunity.

In-depth analysis of the insurance fraud detection market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

The report includes the analysis of the regional as well as global insurance fraud detection market trends, key players, market segments, application areas, and growth strategies.

Insurance Fraud Detection Market Report Highlights

By Component

Solution

Services

By Deployment Mode

On-premises

Cloud

By Enterprise Size

Large Enterprises

Small and Medium-sized Enterprises (SMEs)

By Applications

Payment Fraud and Billing Fraud

Identity Theft

Claims Fraud

Money Laundering

By Region

Asia-Pacific (China, India, Japan, Australia, South Korea, Rest of Asia-Pacific)

Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Rest of Europe)

North America (U.S., Canada)

LAMEA (Latin America, Middle East, Africa)

Top Trending Reports:

Banking Wearable Market https://www.alliedmarketresearch.com/banking-wearable-market-A06966

Marine Cargo Insurance Market https://www.alliedmarketresearch.com/marine-cargo-insurance-market-A14731

Dual Interface Payment Card Market https://www.alliedmarketresearch.com/dual-interface-payment-card-market-A108803

Budgeting Software Market https://www.alliedmarketresearch.com/budgeting-software-market-A11766

Chatbot Based Banking Market https://www.alliedmarketresearch.com/chatbot-based-banking-market-A11768

𝐓𝐡𝐚𝐧𝐤𝐬 𝐟𝐨𝐫 𝐫𝐞𝐚𝐝𝐢𝐧𝐠 𝐭𝐡𝐢𝐬 𝐚𝐫𝐭𝐢𝐜𝐥𝐞; 𝐲𝐨𝐮 𝐜𝐚𝐧 𝐚𝐥𝐬𝐨 𝐠𝐞𝐭 𝐢𝐧𝐝𝐢𝐯𝐢𝐝𝐮𝐚𝐥 𝐜𝐡𝐚𝐩𝐭𝐞𝐫-𝐰𝐢𝐬𝐞 𝐬𝐞𝐜𝐭𝐢𝐨𝐧𝐬 𝐨𝐫 𝐫𝐞𝐠𝐢𝐨𝐧-𝐰𝐢𝐬𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 𝐯𝐞𝐫𝐬𝐢𝐨𝐧𝐬 𝐥𝐢𝐤𝐞 𝐍𝐨𝐫𝐭𝐡 𝐀𝐦𝐞𝐫𝐢𝐜𝐚, 𝐋𝐀𝐌𝐄𝐀, 𝐄𝐮𝐫𝐨𝐩𝐞, 𝐨𝐫 𝐀𝐬𝐢𝐚-𝐏𝐚𝐜𝐢𝐟𝐢𝐜.

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

David Correa

Allied Market Research

+1 800-792-5285

email us here

Visit us on social media:

Facebook

X

1 https://www.alliedmarketresearch.com/insurance-fraud-detection-market-A06948