A Framework for Financing Transport Connectivity in the BIMSTEC Region

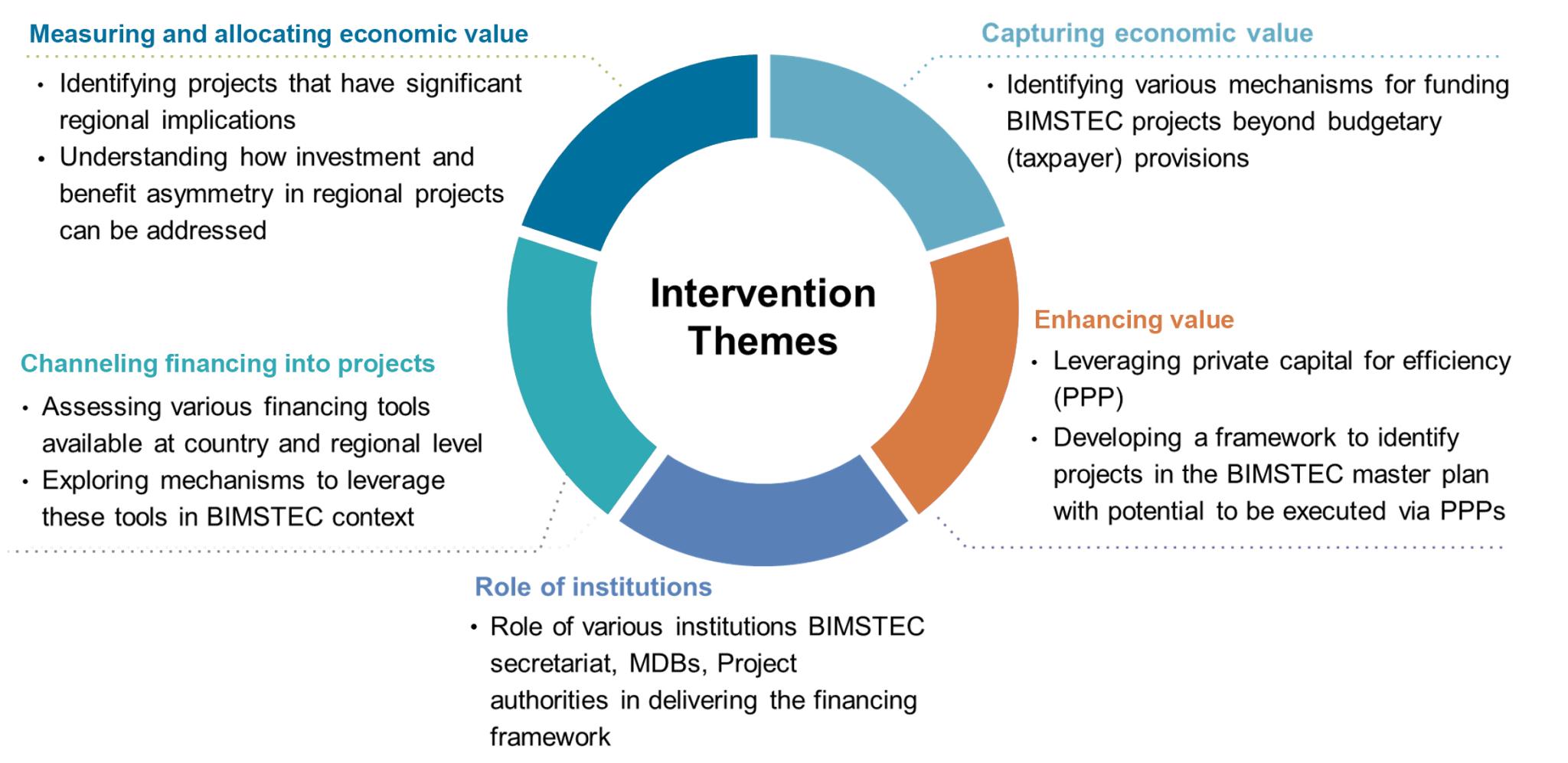

Developing an overarching financing framework for BIMSTEC transport connectivity projects involves interventions across five main segments and themes, as shown in Figure 3.

Figure 3: Segments and Themes to Develop an Overarching Financing Framework

Source: ADB. 2023. Financing Transport Connectivity in the BIMSTEC Region. Manila.

Measuring and allocating economic value. Over 50% of BIMSTEC Master Plan projects in the planning stage have significant cross-border implications. Current economic analyses are conducted at the national level, often excluding neighboring country impacts. BIMSTEC countries should adopt a broader economic analysis framework to measure the shared economic benefits of cross-border projects.

Capturing economic value. Project bankability is crucial for attracting financing. A project is bankable if it has reliable mechanisms within a supportive environment to capture its economic value and generate sufficient income to cover costs. Options for funding include user charges, capital grants, and operational support through revenue or foreign exchange risk guarantees. Due to budget constraints, BIMSTEC countries should explore asset recycling, securitization, land-value capture, non-toll revenue sources, targeted taxation, and carbon pricing to raise funds.

Enhancing value. Attracting private players through various PPP modalities can drive efficiency in developing and operating transport projects. BIMSTEC countries need to develop the capability to conduct financial and value-for-money assessments for PPP projects. Key considerations include robust project planning and preparation, risk-sharing model concession agreements, legal structures in concession agreements for special purpose vehicles, and effective dispute resolution systems.

Developing institutional capacity. Stakeholders, including project authorities, BIMSTEC governments, multilateral development banks, and development partners, must work together to improve project bankability. Country-level interventions should focus on enabling regulations for raising long-term capital and building institutional capacity. Multilateral and bilateral institutions can provide technical assistance to enhance project appraisal capacity. Multilateral development banks can offer credit and loan guarantees to deepen capital markets for institutional investors. Increasing the capacity of existing and new financing institutions and capital markets is crucial to fund transport infrastructure projects.

Channeling financing into projects. To enhance bankability, three interventions are proposed:

- Standardizing coordination and decision-making processes, following models like ASEAN and the EU.

- Encouraging BIMSTEC countries to create transnational regulatory regimes, standardized contract agreements, and harmonized technical standards.

- Recognizing BIMSTEC Master Plan projects as priority projects in member countries.

Ringfenced funding sources are needed for cross-border projects, often seen as high risk by commercial financers and competing with domestic infrastructure priorities. Two fund options under the proposed BIMSTEC Development Fund (BDF) are:

- Fund A: Contributions from member governments to finance regional projects with significant social and economic benefits but limited commercial viability.

- Fund B: Securing low-cost, long-term capital and attracting private sector investment for infrastructure development.

Additionally, establishing a regional financing hub in the BIMSTEC region can be considered.