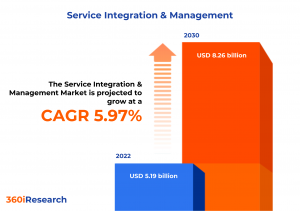

Service Integration & Management Market worth $8.26 billion by 2030- Exclusive Report by 360iResearch

The Global Service Integration & Management Market to grow from USD 5.19 billion in 2022 to USD 8.26 billion by 2030, at a CAGR of 5.97%.

PUNE, MAHARASHTRA, INDIA , December 6, 2023 /EINPresswire.com/ -- The "Service Integration & Management Market by Component (Services, Solution), Organization Size (Large Enterprises, Small & Medium-Sized Enterprises), Vertical - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Service Integration & Management Market to grow from USD 5.19 billion in 2022 to USD 8.26 billion by 2030, at a CAGR of 5.97%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/service-integration-management?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

Service integration & management (SIAM) is a methodology designed to facilitate the seamless integration and delivery of multiple service providers' work outputs into a single, cohesive, business-facing IT service. This framework helps ensure that the performance of all service providers is aligned with the overarching business goals and consistent delivery of services to end-users. SIAM has become an essential framework amidst the increasing complexity of corporate IT environments characterized by multiple service providers. SIAM's role as a centralized management strategy is growing, particularly in sectors where information technology is pivotal, including finance, healthcare, and government. The SIAM market is witnessing growth fueled by the need to manage an intricate web of IT services, with businesses demanding greater agility and compliance with regulatory standards. Organizations are turning to SIAM for the seamless integration of services, enhanced by automation and standardized governance, which ultimately drives cost-effectiveness. However, integration complexities and the challenge of sourcing skilled professionals for conducting SIAM impact the market development. Market players are working on introducing more aligned and precise solutions and services to address these issues. The future growth prospects for the service integration & management market lie in advancements in AI and machine learning, which are expected to refine the efficacy of SIAM solutions.

Vertical: Rising adoption of SIAM to support the rapid pace of technological advancements in IT and telecommunications sector

Within the BFSI sector, service integration and management (SIAM) is pivotal in streamlining processes, ensuring regulatory compliance, and enhancing customer services. As financial institutions focus on digital transformation, integrating fintech, robust cybersecurity measures, and omnichannel customer service platforms become indispensable. Insurance companies leverage SIAM to achieve cohesive management for their data analytics and AI service vendors. SIAM within the energy & utilities sector focuses on ensuring uninterrupted service delivery while optimizing operational efficiency. SIAM supports in managing the complex ecosystem of vendors and technologies involved in smart grid technologies, renewable energy sources, and advanced data analytics, contributing to sustainability initiatives and regulatory adherence while keeping costs in check. The IT & telecommunications industry requires a seamless integration of services to support the rapid pace of technological advancements and evolving consumer expectations. SIAM offers a governance framework that aligns services with business objectives, managing multiple service providers to ensure consistency and reliability in service delivery. As telecom companies expand their 5G networks and IT firms innovate in cloud computing, AI, and IoT, SIAM acts as the glue that brings diverse technologies and processes into a coherent whole. SIAM aids manufacturers in navigating these intricate networks of services and technologies to enhance productivity, reduce downtime, and innovate product development. Industry 4.0 has brought about a revolution in manufacturing with the integration of the Internet of Things (IoT), robotics, and AI. SIAM aids manufacturers in navigating these intricate networks of services and technologies to enhance productivity, reduce downtime, and innovate product development. The retail & consumer goods sector benefits from SIAM by optimizing e-commerce platforms, supply chain management, and customer relationship systems. For the transportation & logistics sector, SIAM ensures that integrated services operate with maximum efficiency in an industry that demands precision, speed, and scalability. With evolving customer expectations for rapid delivery, transportation, and logistics, companies leverage real-time tracking systems, automated warehouses, and efficient route planning. SIAM helps orchestrate the diverse service landscape, ensuring smooth operations and timely deliveries.

Component: Growing importance of training, support, and maintenance to optimize the service value

Consulting in the context of service integration and management (SIAM) is the initial phase where expert advice and guidance are provided to organizations. It involves understanding the client's business needs, assessing the current state of IT services, and designing a strategic approach to integrate and manage various service providers effectively. Integration and implementation are the actionable components of the SIAM framework, which involves the practical application of the strategies developed during the consulting phase. It includes setting up the integration infrastructure, workflows, tools, and systems that enable various service providers to work together efficiently. The services component encompasses the actual IT services managed within the SIAM framework. These may include infrastructure, software, cloud, and user support services. Effective service integration ensures that despite the complexity of having multiple vendors, the end-to-end services delivered to the business are coherent, well-coordinated, and meet the agreed-upon service levels. Solutions refer to the end products or the outcomes of combining consulting, integration, implementation, and services. Business solutions address an organization's essential operational needs, encompassing vital activities such as auditing & invoicing, which ensure financial transactions are recorded accurately and comply with regulations. Contract management is pivotal in establishing and maintaining agreements with partners and suppliers, underlying the importance of clear terms and performance metrics. Moreover, governance, risk, & control mechanisms are crucial in aligning IT strategies with business objectives, safeguarding assets, and ensuring efficiency and integrity. Procurement strategies are refined to optimize the acquisition of goods and services, contributing to the seamless delivery of integrated services. In the tech-centric side of SIAM, technology solutions form the backbone of service delivery. Application technology solutions refer to software applications that provide specific functionalities directly to end-users. These solutions are designed to meet the strategic business needs of an organization, which can be available in customized options. In contrast, infrastructure technology solutions encompass the foundational physical and virtual resources supporting an organization's entire IT environment, including data centers, servers, storage systems, network hardware, and virtualization software. Ensuring that IT services are available, scalable, secure, and efficient is crucial. Training and support are pivotal to the sustainable adoption and efficient use of SIAM frameworks and solutions. Continuous training initiatives ensure that employees are skilled and updated with the latest techniques necessary for maintaining integrated service models. Regarding support, it is fundamental to offer timely and effective assistance to resolve issues, accommodate service requests, and provide guidance, solidifying the organizational capacity for handling complex, multi-supplier ecosystems within SIAM. Maintenance is the proactive component that focuses on the sustenance and improvement of service performance over time, which encompasses the regular review of services, infrastructure, and operational activities to identify areas of optimization.

Organization Size: Rising deployment of SIAM in large enterprises to harmonize an extensive array of IT services

Large enterprises often contend with complex service delivery structures involving multiple suppliers and comprehensive service catalogs. In this context, service integration and management (SIAM) is a strategic framework to govern, integrate, and align these multi-vendor environments effectively. It ensures that disparate services are coordinated as a cohesive unit, facilitating centralized control, consistent service quality, and agile response to evolving business requirements. Large organizations leverage SIAM to harmonize large-scale operations, achieve economies of scale, and maintain a seamless IT and business services landscape. SMEs benefit from SIAM by enabling more efficient resource allocation and streamlined processes, vital for businesses with limited in-house IT capabilities. SIAM allows SMEs to focus on core business functions by ensuring that their IT services are managed coherently by one or multiple external suppliers, reducing complexity and fostering a collaborative ecosystem for all service providers.

Regional Insights:

In the Americas, the service integration and management (SIAM) market is experiencing robust growth driven by the increasing demand for complex service solutions among large enterprises. North America, particularly the United States and Canada, contributes majorly to the market expansion owing to the early adoption of advanced IT infrastructure, a mature outsourcing industry, and high investment in technological innovation. The presence of key industry players and the surge in hybrid cloud deployments also contribute to the market's expansion. The SIAM market is experiencing growth in the EMEA region, with well-established businesses increasingly outsourcing complex services to specialized providers. Furthermore, regulatory mandates in the European Union, such as the General Data Protection Regulation (GDPR), push organizations to reassess and restructure their service management strategies in terms of security, often entailing SIAM frameworks. The Middle East and Africa are also recognizing the value of SIAM, with growth stimulated by a need for operational efficiency and an increasing reliance on technology-driven business processes. The Asia-Pacific (APAC) region is showing rapid growth in the service integration and management market, with emerging economies such as China and India at the forefront. The increasing adoption of cloud-based solutions, the expansion of the IT sector, and the government initiatives for promoting digitalization are major factors contributing to the market's growth. The region shows promise with its rapid economic development, attracting SIAM service providers to invest in these markets.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Service Integration & Management Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Service Integration & Management Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Service Integration & Management Market, highlighting leading vendors and their innovative profiles. These include 4me, Inc., Accenture PLC, Amazon Web Services, Inc., Atos SE, BAE Systems PLC, Capgemini SE, CGI Inc., Coforge Limited, Cognizant Technology Solutions Corporation, Exalate, Fujitsu Limited, HCL Technologies Limited, Hewlett Packard Enterprise Company, Infosys Limited, International Business Machines Corporation, Little Fish (UK) Ltd., LTIMindtree Limited, NTT Data Corporation, Oracle Corporation, Orange Business, Resultant, Science Applications International Corporation, Serco Group PLC, ServiceNow, Inc., Sofigate Group Oy, Tata Consultancy Services Limited, Tech Mahindra Limited, Tietoevry, Wipro Limited, and Wrike, Inc..

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/service-integration-management?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Service Integration & Management Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Component, market is studied across Services and Solution. The Services is further studied across Consulting, Integration & Implementation, and Training, Support & Maintenance. The Solution is further studied across Business Solutions and Technology Solutions. The Business Solutions is further studied across Auditing & Invoicing, Contract Management, Governance, Risk & Control, and Procurement. The Technology Solutions is further studied across Application and Infrastructure. The Services is projected to witness significant market share during forecast period.

Based on Organization Size, market is studied across Large Enterprises and Small & Medium-Sized Enterprises. The Small & Medium-Sized Enterprises is projected to witness significant market share during forecast period.

Based on Vertical, market is studied across Banking, Financial Services, & Insurance, Energy & Utilities, IT & Telecommunications, Manufacturing, Retail & Consumer Goods, and Transportation & Logistics. The Banking, Financial Services, & Insurance is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Europe, Middle East & Africa commanded largest market share of 37.91% in 2022, followed by Asia-Pacific.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Service Integration & Management Market, by Component

7. Service Integration & Management Market, by Organization Size

8. Service Integration & Management Market, by Vertical

9. Americas Service Integration & Management Market

10. Asia-Pacific Service Integration & Management Market

11. Europe, Middle East & Africa Service Integration & Management Market

12. Competitive Landscape

13. Competitive Portfolio

14. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Service Integration & Management Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Service Integration & Management Market?

3. What is the competitive strategic window for opportunities in the Service Integration & Management Market?

4. What are the technology trends and regulatory frameworks in the Service Integration & Management Market?

5. What is the market share of the leading vendors in the Service Integration & Management Market?

6. What modes and strategic moves are considered suitable for entering the Service Integration & Management Market?

Read More @ https://www.360iresearch.com/library/intelligence/service-integration-management?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+1 530-264-8485

ketan@360iresearch.com

1 https://www.360iresearch.com/library/intelligence/service-integration-management?utm_source=einpresswire&utm_medium=referral&utm_campaign=title