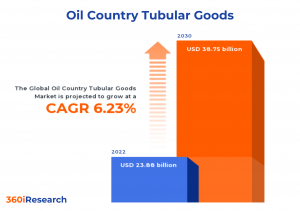

Oil Country Tubular Goods Market worth $38.75 billion by 2030 - Exclusive Report by 360iResearch

The Global Oil Country Tubular Goods Market to grow from USD 23.88 billion in 2022 to USD 38.75 billion by 2030, at a CAGR of 6.23%.

PUNE, MAHARASHTRA, INDIA, November 16, 2023 /EINPresswire.com/ -- The "Oil Country Tubular Goods Market by Type (Casing, Drill Pipes, Tubing), Materials (Alloy Steel, Carbon Steel, Stainless Steel), Manufacturing Process, Grade, Application - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Oil Country Tubular Goods Market to grow from USD 23.88 billion in 2022 to USD 38.75 billion by 2030, at a CAGR of 6.23%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/oil-country-tubular-goods?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

Oil country tubular goods (OCTG) is a specialized category of equipment that is utilized in various stages of oil and gas exploration, drilling, and production processes. These tubular goods are essential components for the safe and efficient extraction of hydrocarbons from onshore and offshore wells, thereby playing a critical role in the global energy industry. OCTGs cater to a diverse range of end-use applications such as drilling activities (including vertical & horizontal drilling), deep-water projects, and enhanced oil recovery projects. Increasing global demand for energy sources and supportive government policies promoting oil and gas exploration and production (E&P) activities have propelled the demand for oil-country tubular goods. However, volatility in oil & gas prices and fluctuations in prices of raw materials used in oil-country tubular goods production can hamper the growth and adoption of the goods. Furthermore, the chances of corrosion and susceptibility of the oil country tubular goods to adverse environmental conditions reduce end-use preference for the goods. However, efforts by major manufacturers to develop innovative materials with improved mechanical properties that can withstand extreme conditions present in deeper wells or highly corrosive environments can expand the scope and applicability of oil-country tubular goods. Furthermore, the expansion of oil-country tubular goods into untapped emerging economies facilitated by collaborative efforts between key players, regulatory bodies, and local governments can create new avenues of opportunities for oil-country tubular goods.

Material: Growing preference for stainless steel materials to tackle corrosive environmental conditions during oil and gas drilling operations

Alloy steel is a popular material choice for OCTG due to its excellent strength, durability, and resistance to harsh environments. This type of steel comprises several elements, such as chromium, nickel, and molybdenum, that enhance its mechanical properties and corrosion resistance. Carbon steel is another commonly used material for OCTG applications due to its cost-effectiveness and versatility. It exhibits similar qualities of strength and durability as alloy steel but with lower corrosion resistance capabilities. Stainless steel material is the preferred option for many OCTG applications where high levels of corrosion resistance are critical.

Application: Use of OCTG for harsh operating environments in offshore projects

Offshore oil and gas production is a rapidly growing category in the energy sector, requiring highly specialized equipment and infrastructure. The harsh environment and unique challenges of offshore projects demand oil country tubular goods (OCTG) that offer high performance, excellent corrosion resistance, and increased durability. Offshore OCTG materials typically comprise advanced metallurgical compositions such as high alloy steel grades or corrosion-resistant alloys, which enable them to withstand extreme pressure, temperature fluctuations, and saline conditions. Onshore oil and gas operations represent a significant portion of the global energy mix as they continue to be a cost-effective solution for meeting rising energy demands. Compared to offshore projects, onshore applications often involve less complex operational settings; however, they still require reliable and efficient OCTG materials to ensure safe extraction processes.

Type: Ability of casing to protect integrity and structural capacity of the wellbore during drilling operations

The casing is the large-diameter pipe installed to line wellbores during drilling operations. It provides structural support to the wellbore walls, isolates different pressure zones, and helps maintain borehole integrity. Drill pipes are essential components used to transmit rotational torque and axial force from the drilling rig surface equipment down to the drilling space deep below the Earth's surface. These tubular goods are designed to withstand various drilling conditions and are typically made from high-strength steel alloys, providing fatigue resistance, torsional strength, and bending capability. Tubing is a smaller diameter pipe installed within the casing that serves as a conduit for transporting produced oil or gas from reservoirs to surface facilities. It plays an essential role in controlling well production rates, maintaining pressure integrity during operations, and reducing chances of formation damage.

Manufacturing Process: Superior mechanical properties and increased pressure resistance of seamless OCTG

Seamless OCTG pipes are manufactured through a solid round billet heating process that involves piercing followed by drawing or rolling without any seam or weld joints. These pipes offer improved mechanical properties, increased resistance to high pressures, and superior performance in demanding applications. Due to their higher strength and durability, seamless OCTG products are often preferred in high-pressure wells where there is an increased risk of failure. Welded OCTG pipes are created by bending steel plates into cylindrical shapes followed by welding along the seam using electric resistance welding (ERW), submerged arc welding (SAW), or other advanced welding techniques. These pipes are generally more cost-effective due to their simpler production process and reduced material usage. Welded OCTG products are suitable for applications with lower pressure requirements, such as shallow wells and onshore operations.

Regional Insights:

The Americas is a major player in the global OCTG market due to its vast shale reserves and robust oil and gas drilling activities. The region has experienced steady growth in recent years as operators continue to invest in advanced drilling technologies such as horizontal drilling and hydraulic fracturing. Major player manufacturers have strategically expanded their production capacities to meet increasing domestic demand for high-quality OCTG products. Asian countries such as China, India, Indonesia, Malaysia, and Thailand are experiencing rapid expansion of their oil & gas sectors due to rising energy demands from growing populations and industrialization. Consequently, there has been an upsurge in demand for quality OCTGs, which attract both local and international manufacturers into these markets. In response to the increasing demand for quality products from both domestic and foreign companies operating within Asia's O&G space. Europe remains an important player in the global OCTG market, primarily supported by extensive oil and gas production activities in some growing economies. The European Union (EU) has stringent environmental regulations that encourage operators to prioritize safety measures and utilize high-quality tubular goods for oil & gas drilling activities. These standards foster increased investment in research & development, driving technological advancements in manufacturing OCTGs that conform to these requirements.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Oil Country Tubular Goods Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Oil Country Tubular Goods Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Oil Country Tubular Goods Market, highlighting leading vendors and their innovative profiles. These include Alleima, ArcelorMittal S.A., Arvedi Group, AUTOBLOK S.P.A., Benteler Automobiltechnik GmbH, Continental Steel and Tube Company, Evraz PLC, Hunting PLC, ILJIN STEEL CO., LTD., JD Rush Company, Inc., JFE Holdings, Inc., Jindal Group, Nippon Steel Corporation, NOV Inc., Sandvik AB, Sanjack Group Co.,Ltd., SB International, Inc., Shandong Saigao Group Corporation, Shengji Group, Sumitomo Corporation, Tata Steel Limited, Techint Group, Tenaris S.A., Tenergy Equipment & Service Ltd., Threeway Steel Co.,Ltd., Tianjin Pipe Corporation, TMK Group, TPS-Technitube Röhrenwerke GmbH, Tubos India., United States Steel Corporation, Vallourec Group, and Voestalpine Tubulars GmbH & Co KG.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/oil-country-tubular-goods?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Oil Country Tubular Goods Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Type, market is studied across Casing, Drill Pipes, and Tubing. The Casing is projected to witness significant market share during forecast period.

Based on Materials, market is studied across Alloy Steel, Carbon Steel, and Stainless Steel. The Carbon Steel is projected to witness significant market share during forecast period.

Based on Manufacturing Process, market is studied across Seamless and Welded. The Welded is projected to witness significant market share during forecast period.

Based on Grade, market is studied across API Grade and Premium Grade. The Premium Grade is projected to witness significant market share during forecast period.

Based on Application, market is studied across Offshore and Onshore. The Onshore is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Europe, Middle East & Africa commanded largest market share of 40.44% in 2022, followed by Americas.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Oil Country Tubular Goods Market, by Type

7. Oil Country Tubular Goods Market, by Materials

8. Oil Country Tubular Goods Market, by Manufacturing Process

9. Oil Country Tubular Goods Market, by Grade

10. Oil Country Tubular Goods Market, by Application

11. Americas Oil Country Tubular Goods Market

12. Asia-Pacific Oil Country Tubular Goods Market

13. Europe, Middle East & Africa Oil Country Tubular Goods Market

14. Competitive Landscape

15. Competitive Portfolio

16. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Oil Country Tubular Goods Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Oil Country Tubular Goods Market?

3. What is the competitive strategic window for opportunities in the Oil Country Tubular Goods Market?

4. What are the technology trends and regulatory frameworks in the Oil Country Tubular Goods Market?

5. What is the market share of the leading vendors in the Oil Country Tubular Goods Market?

6. What modes and strategic moves are considered suitable for entering the Oil Country Tubular Goods Market?

Read More @ https://www.360iresearch.com/library/intelligence/oil-country-tubular-goods?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+ 1 530-264-8485

ketan@360iresearch.com

1 https://www.360iresearch.com/library/intelligence/oil-country-tubular-goods?utm_source=einpresswire&utm_medium=referral&utm_campaign=title