REAG Plays Key Sourcing Role in MCM’s Majority Recapitalization of TechNH

Leading Lower-Middle Market M&A Advisors, REAG support TechNH in Majority Recap by MCM.

Identifying opportunities aligned with our clients' acquisition objectives is fundamental to our buy-side mission.”

CLEVELAND, OH, USA, September 6, 2023/EINPresswire.com/ -- REAG1, a leading lower-middle market investment bank specializing in mergers and acquisitions, is proud to announce their support in the majority recapitalization of TechNH, Inc.2 (TechNH) connecting them with MCM Capital Partners3 (MCM).— Jaclyn Ring, Vice President, REAG

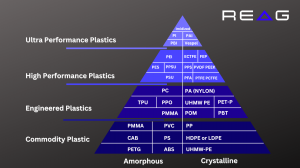

TechNH, headquartered in Merrimack, New Hampshire, boasts a longstanding and rich expertise in molding high performance resins to exacting complex, geometric specifications along with an extensive suite of vertically integrated and secondary value-added services including tool fabrication, machining, assembly, ultrasonic welding, packaging, machining, heat staking and laser marking among others.

The team at REAG recognized the immense potential of this partnership and are proud to have connected TechNH with MCM, sharing in the clarity of vision for propelling businesses towards accelerated, strategic growth.

The transaction is poised to inject substantial capital and resources into TechNH, empowering the company to enhance its already impressive service offerings for existing clientele, while simultaneously bolstering business development initiatives to accelerate expansion.

Greg Gardner, President of TechNH is excited by the opportunity to find the right partner to respect and maintain TechNH legacy, while complementing their team and driving growth.

“We are very fortunate,” remarked Gardner, “to have found MCM and excited to work with them to continue to provide top notch service to our customers and growth opportunities for our TechNH team.”

TechNH's legacy of excellence is enhanced through this collaboration, with MCM providing access to invaluable expertise in sales strategies, digital marketing, and business development. The partnership holds the potential to unlock new avenues of growth for Tech and shape a brighter future for the company.

“We are excited to welcome TechNH to the MCM Capital family,” remarked Greg Ott, Senior Operating Partner at MCM. “Tech has an outstanding reputation in the market and is recognized as a leader in the production of thermoplastic parts utilizing highly engineered resins with geometrically demanding profiles and tight tolerances. TechNH is leading the way in the green energy market and their technical expertise in this area differentiates them as one of the few manufacturers who can address this market’s demanding needs.”

REAG is proud to have sourced this opportunity for MCM and REAG Vice President, Jaclyn Ring remarked, “Identifying opportunities aligned with our clients' acquisition objectives is fundamental to our buy-side mission. Given MCM's strong track record in the Plastics Industry, I recognized that TechNH embodied all the qualities they were seeking. We are thrilled to have played a role in MCM’s ongoing success in this space.”

TechNH is the first platform investment in MCM Capital Partners IV LP, a leveraged SBIC buyout fund. Along with a continued focus on specialty thermoplastic component manufacturers, MCM continues business development initiatives for growth – both organically and through acquisitions – targeting companies generating $2-8M of EBITDA operating in

-Water & Wastewater treatment

-Value-added distribution of critical repair parts

-Sensors & Optics

-Composites

-Motion Control

-Aerospace & Defense

-Diversified Industrial

-Medical Device

MCM Capital Partners IV LP continues to actively seek complimentary add-ons to its fertile and growing portfolio.

MCM Capital Partners (MCM) is a lower-middle market private equity fund. Founded in 1992, MCM is a Cleveland-based private equity firm focused on acquiring niche manufacturers, value-added distributors and service companies generating up to $75 million in annual revenues and having enterprise values of less than $50 million. MCM is proud of its outstanding reputation built on an honest, straight forward approach to transactions.

TechNH is a custom plastic injection molding company built on decades of experience, talented professionals and a reputation of excellence. Based in Merrimack, NH, TechNH is a technical injection molder serving the medical device, general industrial, defense and green energy industries. Founded in 1982, as a specialty mold manufacturer, TechNH has developed expertise in molding high-performance resins to exacting, complex geometric specifications along with an extensive suite of vertically integrated and secondary value-added services including tool fabrication, machining, assembly, ultrasonic welding, packaging, machining, heat staking and laser marking among others.

REAG is a lower-middle market investment banking firm specializing in mergers and acquisitions, strategic ownership planning, and private capital markets advisory, representing both buy-side and sell-side engagements.

Josh Irons

River Avenue Digital

email us here

Visit us on social media:

Facebook

LinkedIn

1 https://www.reag.com

2 https://www.technh.com

3 https://www.mcmcapital.com