Covid-19 Impact of USA Agrochemical ( Biopesticide, Herbicides, Insecticides) Industry, US Agrochemical Manufacturers

US Agrochemical Market is further anticipated to be driven by Investments towards Varieties of Herbicides Coupled with Surge in Market Demand for Bio Pesticides

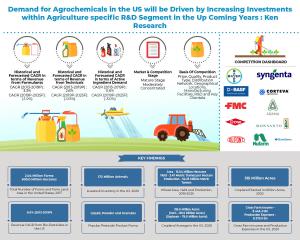

USA, December 14, 2020 /EINPresswire.com/ -- In accordance with the USDA Foreign Agricultural Service, there are approximately 2.1 million farms in the US during 2020; however the number is expected to decline by the year ending 2025.Surge in bio-fuel usage mandated by the Energy Independence and Security Act of 2007 (EISA) through Renewable Fuel Standard (RFS2) program resulted in dramatic changes in crop plantings therefore, giving a boost to pesticide demand.

There are over 1,500 registered biopesticides with 300 active ingredients considered to have pesticide properties as at 2020.

Nano formulations and microencapsulation technologies can improve the stability and residual action of biopesticide products, and this could increase their field use over long term.

Future Prospects of Bio-Pesticides in the US: Biopesticides with potentially less risk to humans & the environment are expected to grow over long term. Within this context, discovery of new substances and research on formulation and delivery would boost commercialization and use of biopesticides. Also, research on integrating biological agents into common production systems is necessary. Over 200 biopesticide product types are sold in the US, compared to 60 analogous products in the European Union (EU) market. As opposed to conventional pesticide type, biopesticides are by their very nature are more harmful and are more specific to target pests. Nanotechnology could contribute to the development of less toxic biopesticides with favorable safety profiles and increased stability of active agents, enhanced activity on target pests, and increased adoption by farmers in the US.

For More Information on the research report, refer to below link:-

https://www.kenresearch.com/agriculture-and-animal-care/crop-protection/us-agrochemical-market-outlook-to-2025/344773-104.html

Industry has witnessed companies engaging in commercializing bio-based chemicals from plant, mineral, bacteria & animal sources: Growing food demand has promoted agrochemical-based institutions to upgrade their product and further switch to greener alternatives by investing in research activities. The presence of global agrochemical players and continuous investment in new product development by these players is one of the key driving factors contributing towards regional growth. The US agrochemical market was observed in maturity alongside stringent regulations regarding the usage of various control approaches in the region are expected to restrict the use of some control methods. Biopesticides is one of the potential areas in which the country has made significant advancements.

Widespread adoption of herbicide-tolerant corn, especially Monsanto’s glyphosate-tolerant gained traction: Majority of the pesticides in US used on corn are herbicides & over 95% of US corn acreage is treated at least once per growing season with pesticides; occasionally fields are treated twice. Increased glyphosate usage on corn has led to a decreased need for other herbicide active ingredients. Several companies are working towards developing new corn varieties with tolerances for different active ingredients, such as dicamba and glufosinate. However, insecticide and fungicide usage in corn are less significant than herbicide.

The report titled “US Agrochemical Market Outlook to 20251 – Increasing Usage of Integrated Pest Management Activities and Bio Pesticides to Drive Market Growth” by Ken Research suggested that US Agrochemical Market is further expected to grow in future majorly due to entries of several foreign players have also contributed towards the same coupled with increasing usage of Bio pesticides in the US. The country’s agro-chemical market is expected to register a positive six year CAGR of 2.3%, 1.6% and 0.4% in terms of revenue by formulants, revenue by technicals and pesticide active ingredient demand respectively during the forecast period 2019P-2025F.

Key Segments Covered:-

Product Type

Herbicides

Glyphosate

Atrazine

2,4-D

S-Metolachlor

Acetochlor

Dicamba

Others

Insecticides

Organophosphates

Carbamates

Pyrethroids

Neonicotinoids

Other

Fungicides

Chlorothalonil

Mancozeb

Other

Other Agricultural Pesticides:-

Fumigants

Defoliants & Desiccants

Rodenticides

Nematicides

All Others

Pesticide Form

Liquid

Granules

Powder

Market Structure

Organized Market

Unorganized Market

Crop Type

Cereal

Fruits

Vegetables

Others

Key Target Audience:-

Venture Capitalist Firms

Agrochemical Manufacturers

Raw Material Suppliers

Research & Development Institutes

Government Bodies & Regulating Authorities

Herbicide Manufacturers and Distributors

Insecticide Manufacturers

Fungicides Manufacturers

Time Period Captured in the Report:-

Historical Period: 2013-2019P

Forecast Period: 2019P–2025F

Companies Covered:-

Bayer

Syngenta

BASF

Corteva Agriscience

FMC Corporation

Others (ADAMA Agricultural Solutions, DOW Chemical, Du Pont, Monsanto, Nufarm and Sumito Chemical)

Key Topics Covered in the Report:-

Executive Summary - US Agrochemical Market

Socio Economic Overview

Country Overview

Cross Comparison of Countries (US, Canada, Mexico, Argentina and Brazil) – Crop Production Summary (Wheat, Coarse Grains, Corn, Barley, Oats, Rye, Sorghum, Rice, Oilseed, Soybean, Cottonsead, Peanut, Sunflowerseed, Rapeseed and cotton)

Need, Opportunity and Industry Size of Agrochemical Market

US Agrochemical Market Constraints

Trends and Developments in the US Agrochemical Market

Selected Digital Technology Trends in the Agrochemical Industry

Agricultural Overview in the US

US Agrochemical Market Industry Life Cycle

US Agrochemical Market Size by Revenue (Formulants and Technicals) and Volume (Agricultural Pesticide Active Ingredient Demand), 2013-2019P

Demand & Supply Side Ecosystem, Preferences & Trends across End Users Market

Overview of Agricultural Pesticide Supply and Demand

Ecosystem for Agrochemical Market in the US

Value Chain Analysis

US Agrochemical Market Segmentation

Snapshot on US Biopesticide Market

Trade Scenario in US Agrochemicals Market, 2017-2018

Comparative Landscape in US Agrochemical Market

Regulatory Landscape in US Agrochemical Market

SWOT Analysis

Decision Making Process by Farmers before Purchasing Agrochemicals in the US

Industry Restructuring in the US Agrochemical Market

US Agrochemical Market Future Outlook and Projections, 2019P-2025F

Analyst Recommendations

Appendix / Research Methodology

For More Information on the research report, refer to below link:-

https://www.kenresearch.com/agriculture-and-animal-care/crop-protection/us-agrochemical-market-outlook-to-2025/344773-104.html

Related Reports:-

https://www.kenresearch.com/agriculture-and-animal-care/crop-protection/brazil-agrochemical-market-outlook/299311-104.html

https://www.kenresearch.com/agriculture-and-animal-care/crop-protection/indonesia-agrochemicals-market-outlook/303063-104.html

https://www.kenresearch.com/agriculture-and-animal-care/crop-protection/europe-agrochemical-market-outlook/313759-104.html

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ankur Gupta

Ken Research Private limited

+91 90153 78249

ankur@kenresearch.com

1 https://www.kenresearch.com/agriculture-and-animal-care/crop-protection/us-agrochemical-market-outlook-to-2025/344773-104.html