Rong360 Jianpu Technology(NYSE:JT) Big Data Institute: Chengdu Sees Highest First-home Mortgage Rate in China

Jianpu Technology (NYSE:JT)

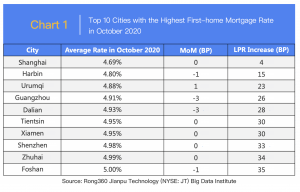

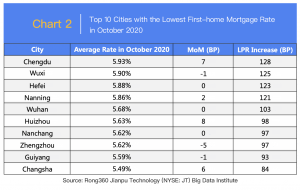

BEIJING, 中国, November 4, 2020 /EINPresswire.com/ -- 3. Ranking: Chengdu Saw Highest Mortgage Rate for First-time Homebuyers NationwideIn October 2020 (with data in statistics collected from September 20, 2020 to October 18, 2020), a list of top 10 cities with the lowest mortgage rates was unchanged compared with the prior month. However, Changsha entered into a list of the top 10 cities with the highest mortgage rates after a MoM increase of 6BPs in the first-home mortgage rate. Meanwhile, Shenyang was knocked off the top 10 list. In addition, the mortgage rate in Chengdu was up again, allowing it to have the highest rate in China, followed by Hefei and Wuxi, for which rankings dropped accordingly from a month earlier.

4. Trends: Regulations on Property Market Continue to be Tightened; Mortgage Rates May Slightly Rise by Year-end

September and October are usually selling seasons for property market, while performance was relatively mild this year comparing with the same period in previous years. Meanwhile, self-regulations of the property market tend to be stricter. In terms of policies, more tier-2 and tier-3 cities joined the group in tightening housing mortgages: for commercial housing mortgages, Wuxi, Shenyang, Changzhou and Changchun increased the lending rates, as well as adjusted minimum down payment ratios for the second home to 60%, 50%, 60% and 40% respectively; Wuxi and Dongguan adjusted policies on housing accumulation fund loans as well. A number of banks said that the amount of mortgages available is relatively tight due to policy requirements. And new mortgages may not be available until January next year while the amount of the banks suspending the business of housing mortgages is increasing.

In addition, regulations and rules on financing for real estate enterprises, and supervision on bank’s illegal loans to the property market tend to be tightened. The People’s Bank of China said during the third-quarter financial statistics data briefing on Oct. 14 that responses to new rules of financing for real estate companies were active and positive, thus their applications will be extended in a steady way . The number and value of violation tickets issued by the China Banking and Insurance Regulation Commission to banks both reached a new high in the recent two months, especially in terms of illegal uses of loans.

The People’s Bank of China (PBOC) on Oct. 15 kept the rate on one-year medium-term lending facility (MLF) to financial institutions steady at 2.95%, compared to the previous operation, indicating a LPR quotation is very likely to remain unchanged this month and reducing the possibility of lower mortgage rates. Though the national average mortgage rates maintained the same as a whole as the previous month, we can see in terms of amount and extent, the trend of rising mortgage rates is reflecting in more tier-2 and tier-3 cities, which is expected to slightly raise the national average by the end of this year.

Media Contact

Jianpu Technology

+86 10 8262 5755

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

1 http://www.jianpu.ai/