Warehousing Automation & Investment within Transport Infrastructure to Drive Market Revenue in Saudi Arabia: KenResearch

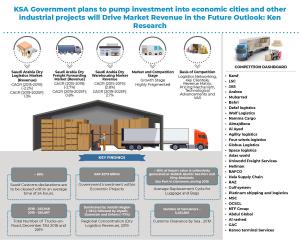

KSA Dry Logistics Market is driven by Introduction & Adoption of Newer Technologies will have Strong Influence on Delivery & Service Offerings in the Industry.

SAUDI ARABIA, October 21, 2020 /EINPresswire.com/ -- • During Covid pandemic, cargo was backlogged at KSA’s major container ports; travel restrictions led to a shortage of truck drivers to pick up containers and ocean carriers canceled sailings.• Saudi customs authority has restricted freight forwarders to only 2 brokers from each company at all ports of entry, which is causing delays in freight clearances.

• Strong demand is anticipated for full fledged integrated distribution centers including logistics facilities, dry storage; cold storage and supporting retail facilities.

Technological advancements would ensure improved supply chain transparency, enhance supply chain security and lead to improved cost efficiency within logistics framework in Saudi Arabia. Rise of automation and VASs to give a competitive edge is changing the way warehouses operate. In addition, warehousing companies are seeking business support, such as IT solutions and financing from both government as well as non-government sources.

For More Information on the research report, refer to below link: -

https://www.kenresearch.com/automotive-transportation-and-warehousing/logistics-and-shipping/saudi-arabia-dry-logistics-and-warehousing-market-outlook-to-2025/366821-100.html

Development of Logistics Infrastructure: Government of KSA is taking initiatives for development of economic zones and logistics centers to accommodate the increasing demand of freight forwarding owning to economic diversification & Vision 2030. KSA government aims to aggressively drive and position 50 islands and 100 miles of Red Sea as a global tourist destination. Expansion of Red Sea corridor in Jeddah, the minerals hub in Yanbu, King Abdullah port and NEOM project are also expected to drive the freight forwarding industry. Saudi Arabian government is investing to improve its port infrastructure that envisages using innovative technological solutions to also automate processes & activities. With the new plans of improvement, the rail network is expected to have connectivity with ports, major transport hubs, warehouses, freight terminals, and distribution centres, which will decrease the transportation time from coast to coast (which currently takes about 10 days, and is expected to decrease to 10-15 hours by rail).

KSA Government opened the retail and wholesale sectors to 100% foreign ownership and has launched a large privatization programme. Competition will intensify due to entrance of global players due to flexible rules and regulations thus, leading to surge in M&A’s and further intensifying the competition in the freight forwarding market. The government is also developing Free Zones near KSA airports which are aimed to attract foreign businesses by relaxed licenses & taxation policies, thus increasing more foreign investments in the country.

Increasing adaptation of E-Commerce as a result of restrictions posed by the COVID-19 pandemic will bring change in terms of consumer buying behaviour. Big retailers for instance, Carrefour and Abu Dawood reported surge in online sales of up to 200-300% in 2020 and further expect an escalating growth trajectory in the long-term.

The report titled “Saudi Arabia Dry Logistics and Warehousing Market Outlook to 20251 – Warehousing Automation and Investment within Transport Infrastructure to Drive Market Revenue)” by Ken Research suggested that the dry logistics market is further expected to grow in the near future as companies are willing to expand in terms of fleet size and warehousing space; potential regional opportunities; shifting to asset light model for warehousing / storage availability. The government can establish a logistics manpower framework, establish a skills council for logistics; pricing at sea ports to attract FDI, revise regulations around customs licensing, promoting bonded logistics & strengthen-ing trade relations with other countries. The market is expected to register a positive six year CAGR of 1.3% in terms of revenue during the forecast period 2019-2025F.

Key Segments Covered in KSA Dry Logistics Market

• Service Mix

Freight Forwarding

Warehousing

Value Added Services

• Regions

Jeddah

Riyadh

Dammam

Rabigh

Others (Al- Khobar, Medina, Tabuk and several other cities)

• KSA Dry Freight Forwarding Market

Mode of Freight

Road Freight

Air Freight

Sea Freight

Rail Freight

International and Domestic Freight

Road Freight

Air Freight

Sea Freight

International and Domestic Companies

Flow Corridors (International Freight)

Asian Countries

European Countries

Middle East

NAFTA (North American Free Trade Agreement)

Other Regions (Africa and South America)

• KSA Dry Warehousing Market

Business Model

Industrial / Retail

Container Freight / Inland Container Depots

End Users

Construction Material / Industrial

Consumer Retail

Food and Beverage

Healthcare

Automotive

Others (Agriculture, Chemicals and Rest)

Entities

Real Estate Companies

Captive Companies

Logistics Companies

Cities

Jeddah

Riyadh

Dammam

Others (Al-Khobar, Medina, Tabuk and other cities)

• KSA Customs Clearance Market

Overall Value Added Services

Customs Clearance Revenue by Sea

Customs Clearance Revenue by Air

Transhipment Cargo Volume

Discharged Transhipment Containers

Loaded Transhipment Containers

Key Target Audience

• International Domestic Freight Forwarders

• Warehousing Companies

• Logistics Companies

• Logistics Consultants

• Customer Clearance and Container Yards

• Integrated Logistic Companies

Time Period Captured in the Report:

• Historical Period: 2014-2019

• Forecast Period: 2019–2025

Companies Covered:

• Karsf

• LSC

• JAS

• Arabco

• Mubarrad

• Bahri

• Defaf logistics

• Wolf Logistics

• Namma Cargo

• Almajdieou

• Al Ayed

• Agility logistics

• Four winds logistics

• Globus Logistics

• Space logistics

• Atlas world

• Uniworld Freight Services

• Hellman

• BAFCO International Logistics and Shipping Co.

• Hala Supply Chain

• RAZ

• Gulf system

• Platinum shipping and logistics

• MSC

• OCSCL (Oriental Commercial & Shipping)

• NTF Group

• Abdui Global

• Al rashed

• GAC

• Kanoo terminal Services

Online Retail Companies Covered:

• Carrefour

• Panda Retailing

• Abdullah Othaim Market

• Danube

• Tamimi Market

• Lulu Hypermarkets

Key Topics Covered in the Report

• Saudi Arabia Overview and Major Economic Zones

• Saudi Arabia Dry Logistics and Warehousing Market

• Trade Scenario

• Saudi Arabia Dry Freight Forwarding Market

• Saudi Arabia Dry Warehousing Market

• Snapshot on Saudi Arabia Customs Clearance and Transhipment Market

• Industry Analysis (Decision Making Process, SWOT Analysis, VAT Impact and Law of Public Transport on Roads of KSA)

• Cost of Setting up a Logistics Business in Saudi Arabia

• Comparative Landscape – KSA Dry Logistics Market

• Comparative Landscape in Saudi Arabia Online Retail Market

• Recommendations / Success Factors

• Research Methodology

• Appendix

For More Information on the research report, refer to below link: -

https://www.kenresearch.com/automotive-transportation-and-warehousing/logistics-and-shipping/saudi-arabia-dry-logistics-and-warehousing-market-outlook-to-2025/366821-100.html

Related Reports

Ankur Gupta

Ken Research Private limited

+91-9015378249

ankur@kenresearch.com

Visit us on social media:

Facebook

Twitter

LinkedIn

1 https://www.kenresearch.com/automotive-transportation-and-warehousing/logistics-and-shipping/saudi-arabia-dry-logistics-and-warehousing-market-outlook-to-2025/366821-100.html