Rong360 Jianpu Technology Survey finds 1/4 of the Chinese population never check their credit records

Jianpu Technology (NYSE:JT)

BEIJING, CHINA, August 28, 2020 /EINPresswire.com/ -- Is it necessary to look into the credit record of your partner before getting married? What should you do when your new company requires your credit record? What if I’m prohibited from taking the high-speed train as my name is on the credit blacklist? Earlier before, credit records were used only when people apply for a credit card or a loan. Now, as credit information is becoming more widely used, more and more are realizing the value of this “Credit ID”.Consequently, there have been heated discussions on the internet about how to erase negative credit records and how to handle excessive credit records. Besides, it is not unusual that people are denied of services at formal financial institutions due to the lack of credit records, which reflects that the general public are not sufficiently aware of the importance of personal credit records.

So to speak, there is still room for China to improve its credit reporting system and popularize relevant knowledge. According to the Survey on the Credit Awareness of Chinese People recently released by Rong360 Jianpu Technology1 (NYSE: JT), the public calls for abundant contents and high accuracy in personal credit reports. 38.8% of the respondents showed their conditionally support for extending report coverage. As to credit knowledge, only 10.73% of the respondents said they were well informed of their personal credit records.

1/4 of the respondents noted that they had never checked their credit records

As a “Credit ID”, personal credit records have already been widely used. Taking the credit reporting by the People’s Bank of China as an example, the individual credit reporting system received 2.4 billion inquiries in 2019, with a daily average of 6.57 million. According to PBOC’s statistics of the reasons for inquiries in the second quarter of 2020, 42.6% of the inquiries were for pre-loan examination and approval, 52.6% for post-loan management, and 4.8% for other purposes such as qualification review of guarantors.

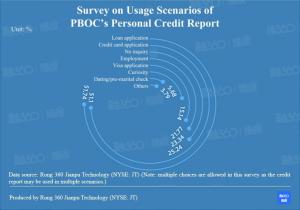

In fact, its uses are far beyond credit and loan. The research results of Rong 360 Jianpu Technology (NYSE: JT) revealed that over a half of the respondents had inquired about their personal credit records when applying for loans or credit cards; more than 20% did so when applying for visa or handling employment formalities; and 5.68% said they checked the personal credit records of their dates or spouses before marriage.

On the internet, the hashtag “Should a couple check each other’s credit record before marriage?” hit the headline from time to time, among other topics such as “buying matrimonial home and cars” and “giving betrothal gifts and dowries” that are often discussed by people at the age of marriageable age. A netizen shared a story about a friend who broke up with her boyfriend shortly before getting married. The reason was that she checked his credit record and found he had a lot of credit card debts, petty loans as well as many overdue records.

Despite the wide uses of credit reports in different scenarios, there are still many people who have never inquired about or used their credit reports. According to Rong 360 Jianpu Technology (NYSE: JT)’s survey data, 25.24% of the respondents claimed that they had never inquired about their personal credit records. Actually, the Credit Information Center of the People’s Bank of China provides two free inquiries for each person each year. Regular inquiry is recommended to avoid accidental credit damage without your knowledge.

The recent news entitled “a Sichuan woman found a loan of 12 million under her name without her knowledge”, which has attracted a lot of attention, gives a warning to people who have never inquired about their credit records and reminds us of the necessity of making regular credit inquiries and maintaining good personal credit records.

Di Wang

Jianpu Technology

10 8262 5755

email us here

1 http://ir.jianpu.ai