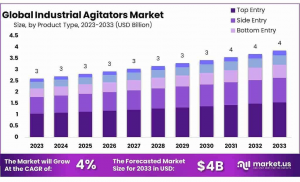

Industrial Agitators Market to Reach USD 4 Billion by 2033, Growing at 4% CAGR from USD 3 Billion in 2023

Industrial Agitators Market size is expected to be worth around USD 4 bn by 2033, from USD 3 bn in 2023, growing at a CAGR of 4% forecast period 2023 to 2033.

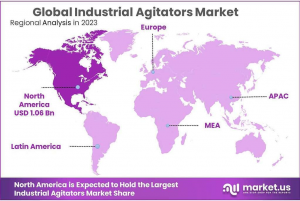

North America held over 41% revenue share in 2023, driven by demand from process industries for reliable and efficient agitators.

”

NEW YORK, NY, UNITED STATES, January 28, 2025 /EINPresswire.com/ -- Report Overview— Tajammul Pangarkar

Industrial agitators are mechanical devices used to mix or stir fluids, including liquids, gases, and slurries, in various industrial settings to promote chemical reactions, heat transfer, and homogenization. These devices are crucial components in sectors like chemicals, food and beverage, pharmaceuticals, cosmetics, and water treatment. They vary in their configuration and technology, ranging from simple paddles to complex impellers and from static mixers to rotary tank agitators.

The industrial agitators market is experiencing growth due to increasing demand from industries that require consistent mixing and processing of products. These agitators are becoming more sophisticated with advancements in automation and control technologies, making them more efficient and adaptable to different operational needs. This market's expansion is supported by a surge in manufacturing activities and a growing focus on production efficiency and compliance with environmental regulations.

The growth of the industrial agitators market is propelled by the expanding chemical and pharmaceutical sectors, where precision and consistency in mixing processes are critical. Additionally, innovations in agitator technologies that offer enhanced energy efficiency and process control are further stimulating market growth. The integration of IoT and AI for real-time monitoring and control also contributes to the development of more advanced agitator systems.

Demand for industrial agitators is driven by the need for modernization in process industries and the increasing adoption of automated processes across various sectors. As industries strive to improve process efficiency and product quality, the role of effective mixing equipment becomes paramount. Moreover, the shift towards customized agitators tailored for specific industrial applications is creating a more dynamic market environment.

Significant opportunities lie in the industrial agitators market through the adoption of green and sustainable technologies. As environmental regulations become stricter, industries are looking for eco-friendly and energy-efficient mixing solutions. This shift presents an opportunity for manufacturers to innovate and develop agitators that minimize energy consumption and reduce environmental impact.

A key driving factor for the industrial agitators market is the stringent regulatory standards imposed by governments worldwide to ensure safety and environmental compliance in manufacturing processes. These regulations often require the upgrading or replacement of old equipment with technologically advanced solutions that are safer, more efficient, and less polluting, thus driving ongoing demand and innovation in the agitator market.

Get a Sample PDF Report: https://market.us/report/industrial-agitators-market/request-sample/

Key Takeaways

• The Industrial Agitators Market is set to reach USD 4 billion by 2033, growing at a CAGR of 4% from USD 3 billion in 2023.

• In 2023, Top Entry agitators held a significant market share of over 40.3%, showcasing their efficiency in diverse industrial applications.

• The Large Tank model type secured a commanding position with a share exceeding 45.5% in 2023, emphasizing its efficiency in handling substantial volumes.

• Top Mounting agitators dominated the market in 2023, securing over 51.2% share, highlighting their widespread preference for efficient and adaptable industrial processes.

• Solid Mixture agitators took center stage in 2023, capturing a substantial market share of over 56.4%, underscoring their effectiveness in handling processes involving solid materials.

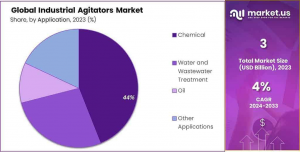

• The Chemical application segment showcased robust dominance in 2023, securing a substantial market position with a share exceeding 44.4%, reflecting the pivotal role of agitators in chemical processes.

• North America held over 41% revenue share in 2023, driven by demand from process industries for reliable and efficient agitators.

Industrial Agitators Market Segment Analysis

By Product Type Analysis

In 2023, the industrial agitators market was prominently led by the Top Entry segment, which held over 40.3% of the market share due to its efficiency and adaptability across diverse applications. Side Entry agitators also marked a strong presence, favored for their industry-specific solutions that cater to unique mixing needs. Meanwhile, Bottom-entry agitators were valued for their effectiveness in processes that require mixing from the bottom, maintaining a solid market share.

The Portable agitators segment saw steady growth, driven by their mobility and the flexibility they offer in moving across various processing units. Lastly, Static agitators continued to be a preferred choice in industries that prioritize continuous and stable mixing, thanks to their reliability and minimal maintenance needs. Collectively, these segments illustrate a dynamic and evolving market landscape, highlighting the diverse requirements and applications within industrial mixing operations.

By Model Type Analysis

In 2023, the Large Tank segment dominated the industrial agitators market, securing over 45.5% market share due to its widespread use in mixing large volumes across industries. This highlights the demand for high-capacity agitators in industrial processes. Portable agitators also gained significant traction, valued for their flexibility and ease of use in various on-the-go applications.

Similarly, Drum agitators held a noteworthy market presence, catering to industries requiring efficient mixing in drum containers, especially for smaller batches. The Other model types category encompassed a variety of specialized and innovative agitators designed for unique industrial applications, reflecting the adaptability of agitator technology to evolving market needs. Together, these segments illustrate a dynamic market landscape driven by diverse industrial mixing requirements.

By Mounting Analysis

In 2023, the Top Mounting segment dominated the industrial agitators market, holding a commanding 51.2% share, driven by its efficiency and adaptability across various industrial processes. Side Mounting agitators also secured a significant market presence, favored for their effectiveness in applications requiring lateral agitation. Meanwhile, Bottom Mounting agitators maintained a strong foothold, valued for their crucial role in processes that demand mixing from the bottom. These segments collectively highlight the diverse preferences and functional advantages of different mounting configurations in industrial mixing applications.

By Form Analysis

In 2023, the Solid Mixture segment dominated the industrial agitators market, holding a substantial 56.4% share, emphasizing the critical role of agitators in mixing and homogenizing solid materials. Solid-liquid mixture agitators also captured a significant market share, driven by their ability to efficiently blend solids with liquids, making them widely adopted across industries.

Similarly, Liquid-Gas Mixture agitators maintained a strong presence, essential for industries requiring effective gas dispersion into liquid phases. The Liquid-Liquid Mixture segment also contributed notably, highlighting the importance of agitators in achieving precise and uniform liquid blending. Collectively, these segments underscore the diverse applications and growing demand for industrial agitators across various processing industries.

By Application Analysis

In 2023, the Chemical application segment dominated the industrial agitators market, securing a 44.4% share, highlighting the essential role of agitators in ensuring efficient mixing for high-quality chemical production. The Water and Wastewater Treatment segment also held a significant market position, driven by the need for effective treatment processes to maintain water quality and safety.

Similarly, the Oil segment maintained a strong presence, with agitators playing a critical role in blending, emulsification, and suspension processes essential for oil production efficiency. Additionally, the Other Applications category encompassed a diverse range of industries with unique mixing needs, reflecting the adaptability of agitators in various industrial processes. These segments collectively emphasize the expanding role of industrial agitators across multiple industries.

Buy Now: https://market.us/purchase-report/?report_id=52260

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

• Top Entry

• Side Entry

• Bottom Entry

• Portable

• Static

By Model Type

• Large Tank

• Portable

• Drum

• Others

By Mounting

• Top Mounting

• Side Mounting

• Bottom Mounting

By Form

• Solid Sloid Mixture

• Solid-liquid Mixture

• Liquid Gas Mixture

• Liquid Liquid Mixture

By Application

• Chemical

• Water and Wastewater Treatment

• Oil

• Other Applications

Top Emerging Trends

1. Automation and Smart Agitators: The integration of automation and smart technologies is a key trend in the industrial agitators market. Industries are increasingly adopting IoT-enabled agitators that allow real-time monitoring, remote control, and predictive maintenance. These smart agitators enhance efficiency, reduce downtime, and improve overall process control. Advanced sensors and AI-driven analytics are helping manufacturers optimize mixing parameters, ensuring consistency in production. As industries focus on automation to streamline operations and reduce human intervention, the demand for intelligent, self-regulating agitators is expected to grow significantly in the coming years.

2. Energy-Efficient Agitator Designs: With rising energy costs and a growing focus on sustainability, energy-efficient agitator designs are gaining traction. Manufacturers are developing agitators with optimized impeller shapes, variable speed controls, and high-efficiency motors to minimize power consumption. These advancements help industries achieve cost savings while reducing their carbon footprint. Additionally, improved mixing efficiency reduces processing time, leading to increased productivity. The push for green manufacturing practices is further driving demand for agitators that offer superior energy efficiency without compromising performance, making this a critical trend in the market.

3. Growing Demand for Customization: Industries are seeking tailor-made agitator solutions to meet their specific mixing requirements. Whether it’s pharmaceutical, chemical, or food processing applications, companies are looking for agitators designed to handle unique viscosities, temperatures, and batch sizes. Manufacturers are responding by offering modular agitator systems that can be customized with different impeller types, motor speeds, and material compositions. The shift towards process optimization and industry-specific needs is fueling this demand, ensuring that businesses get agitators that maximize efficiency while adhering to regulatory and quality standards.

4. Rising Adoption of Portable Agitators: Portable agitators are becoming increasingly popular due to their flexibility, mobility, and cost-effectiveness. These agitators allow industries to mix different materials across multiple locations without investing in large fixed installations. The food and beverage, chemical, and pharmaceutical sectors are particularly embracing portable agitators for batch processing and on-site mixing. Their lightweight design, ease of installation, and compatibility with various containers make them a preferred choice.

5. Advanced Materials for Durability: The shift towards corrosion-resistant and high-strength materials in agitator manufacturing is a growing trend. Industries dealing with aggressive chemicals, high temperatures, or abrasive substances require agitators made from materials like stainless steel, titanium, and coated alloys. These materials improve agitator lifespan, reduce maintenance costs, and enhance mixing efficiency. With stricter industry regulations and increasing demand for durability, manufacturers are focusing on advanced material technologies that ensure long-term performance, safety, and reliability, making this trend a key driver of market innovation.

Top Use Cases

1. Chemical Processing and Mixing: Industrial agitators play a crucial role in chemical processing, ensuring consistent blending, reaction control, and homogenization of raw materials. They help maintain product quality, optimize reaction rates, and enhance process efficiency. From polymers to specialty chemicals, agitators support precise formulation and dispersion, making them essential in the chemical industry.

2. Water and Wastewater Treatment: Agitators are widely used in water and wastewater treatment plants to aid in flocculation, coagulation, and aeration processes. They help in efficiently mixing chemicals, breaking down impurities, and ensuring uniform water quality. Their role in environmental sustainability and compliance with regulations makes them vital for municipal and industrial wastewater management systems.

3. Food and Beverage Processing: In the food and beverage industry, agitators ensure uniform mixing of ingredients, emulsification, and aeration in processes like dairy production, brewing, and sauce manufacturing. They help maintain product consistency, texture, and stability while meeting stringent hygiene standards. Their ability to handle viscous and temperature-sensitive materials makes them essential in food processing.

4. Pharmaceutical and Biotech Manufacturing: Agitators are critical in the pharmaceutical and biotech industries for precise drug formulation, fermentation, and bio-processing. They ensure uniform mixing of active ingredients, enhance reaction efficiency and maintain sterility in sensitive production environments. Their use in vaccine production, antibiotics, and API manufacturing underscores their significance in the healthcare sector.

5. Oil, Gas, and Petrochemicals: In the oil and gas sector, agitators facilitate blending, emulsification, and sludge treatment in refineries and petrochemical plants. They play a key role in stabilizing crude oil, dispersing additives, and improving separation processes. Their ability to withstand harsh conditions and handle high-viscosity fluids makes them indispensable in petroleum refining and processing.

Regional Analysis

In 2023, North America dominated the industrial agitators market, accounting for over 41% of the revenue share, driven by the rising demand for reliable, efficient, and customized agitators across various process industries. The region's focus on technological advancements and industrial automation further contributes to its strong market presence.

Asia Pacific is projected to be the fastest-growing region, led by strong economies such as China, India, and Japan. The shift from traditional production methods to more efficient, on-demand manufacturing is fueling industrial growth, boosting demand for industrial agitators across various industries.

The industrial agitators market is also expanding in Latin America, particularly in Brazil, due to the rapid growth of the food & beverage industry and the expansion of the oil & gas sector. As manufacturing activity increases, the need for high-performance mixing solutions continues to rise, driving market demand across the region.

Key Players Analysis

◘ Suzler Ltd.

◘ Xylem Inc.

◘ SPX Corp.

◘ EKATO Group

◘ Philadelphia Mixing Solutions, Ltd.

◘ Fluid Kotthoff GmbH

◘ SPX Flow

◘ Zucchetti Srl

◘ MIXEL

◘ INOXPA

◘ Other Key Players

Recent Developments Industrial Agitators Market

— In 2023, Sulzer reported revenues of approximately 3.3 billion CHF, reflecting stable growth driven by strong demand for flow equipment, services, and chemicals. The company focused on sustainability, circular economy solutions, and digital transformation to enhance operational efficiency and market competitiveness.

— In May 2021, SPX FLOW completed a $65 million acquisition of Philadelphia Mixing Solutions, enhancing its mixing solutions portfolio.

Strategic Initiatives

— Product Portfolio Expansion: Companies are investing in R&D to develop advanced formulations that meet regulatory and consumer demands.

— Geographic Expansion: Focus on high-growth regions like Asia-Pacific and the Middle East to capitalize on industrialization trends.

— Sustainability Initiatives: Efforts to align with global sustainability goals and minimize environmental

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.