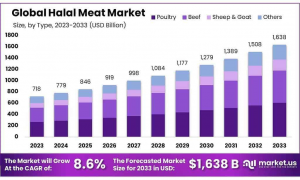

Halal Meat Market to Reach USD 1,638 Billion by 2033, Growing at an 8.6% CAGR from USD 718 Billion in 2023

Halal Meat Market was valued at USD 718 Bn and is expected to reach USD 1638 Bn in 2033. Between 2023 and 2033, this market is estimated to CAGR of 8.6%.

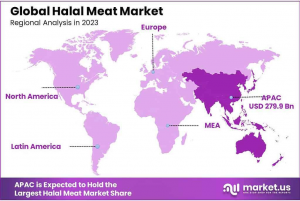

In 2023, Asia Pacific held the leading position in the global market, with a market share of 38.9%.

”

NEW YORK, NY, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- Report Overview— Tajammul Pangarkar

Halal meat refers to meat that is slaughtered and processed according to Islamic dietary laws outlined in the Quran. The process, known as "Zabiha," involves slaughtering the animal by a Muslim, invoking the name of Allah, ensuring complete blood drainage, and maintaining strict hygiene and ethical handling standards. Halal meat excludes pork and any meat from animals that were dead before slaughter. This meat is considered cleaner and more humane, making it a preferred choice not only among Muslims but also among consumers looking for ethical and high-quality meat.

The Halal Meat Market represents the global industry involved in producing, processing, and distributing halal-certified meat and meat products. It caters primarily to Muslim consumers but has also gained traction among health-conscious and ethical meat consumers. The market is witnessing significant growth due to increasing Muslim populations, rising disposable income, and greater awareness of halal certification. The industry encompasses a range of meat types, including poultry, beef, lamb, and seafood, offered in fresh, frozen, processed, and ready-to-eat formats.

The growing Muslim population worldwide is a key driver of the halal meat market. Countries in the Middle East, Asia-Pacific, and parts of Europe and North America are experiencing increasing demand due to rising awareness of halal dietary laws. Furthermore, globalization and increased availability of halal-certified products in mainstream retail chains are fueling market growth.

Demand for halal meat is surging due to rising consumer preference for hygienic, safe, and high-quality meat products. The growing trend of religious adherence and increasing disposable income among Muslim populations are expanding the market reach. Non-Muslims are also driving demand due to perceptions of halal meat being free from harmful additives and more ethically sourced.

The halal meat market presents opportunities for expansion into non-Muslim regions where halal food is gaining acceptance. The integration of blockchain and traceability technology in halal certification is enhancing consumer confidence. Additionally, the rise of e-commerce and online halal meat delivery services is creating new growth avenues.

Stringent government regulations and halal certification standards are encouraging businesses to adopt halal-compliant practices. The rise in global halal tourism and the increasing presence of halal restaurants and food outlets are further driving market demand. Additionally, major food chains and multinational brands are expanding their halal product offerings, contributing to overall market growth.

Get a Sample PDF Report: https://market.us/report/halal-meat-market/request-sample/

Key Takeaways

• Halal Meat Market is expected to reach USD 1638 billion by 2033, with an 8.6% CAGR between 2023-2033.

• Poultry hold a 35.3% market share in 2024 due to versatility and lower fat content.

• Solid Halal Certification captures over 64.2% market share in 2024, emphasizing consumer trust.

• Fresh meat dominates with 85.6% market share in 2024, driven by freshness and taste.

• Convenience stores lead with 72.4% market share in 2024, offering accessibility and extensive products.

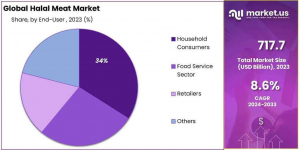

• Household consumers hold a 34.5% market share in 2024, driving market demand.

• Asia Pacific dominates the market with a 38.9% share in 2024, driven by the Muslim population and investments.

• The University of Missouri found that the average price of Halal meat in the United States was 20% higher than conventional meat in 2023.

• University of Florida found that the demand for Halal meat in the United States is expected to increase by 10% annually until 2024 due to the growing Muslim population.

By Type Analysis

The poultry segment led the halal meat market in 2024, holding a 35.3% share due to its versatility, lower fat content, and broad consumer appeal. Its adaptability to various cuisines makes it a preferred choice for both Muslim and non-Muslim consumers. Poultry's economic advantages, shorter production cycles, and competitive pricing ensure steady supply and affordability. With strong halal certification adherence and growing demand for lean protein, poultry continues to dominate the market, catering to evolving dietary trends worldwide.

By Certification Type Analysis

In 2024, Solid Halal Certification dominated the market with a 64.2% share, reflecting strong consumer preference for halal-certified meat. Certification ensures compliance with Islamic dietary laws, making it highly sought after by Muslim consumers and those valuing religious adherence. Meanwhile, Non-Certified meat accounted for the remainder, catering to consumers prioritizing taste, cost, or convenience over certification. The growing awareness of food origins and halal standards continues to drive demand, reinforcing the market's expansion and increasing reliance on certified products.

By Packaging Type Analysis

In 2024, the Fresh Segment dominated the halal meat market with an 85.6% share, driven by its superior taste, texture, and natural quality. Consumers prefer fresh halal meat for its freshness, tenderness, and lack of additives, aligning with health-conscious trends. While Frozen meat holds a smaller share, it remains essential for regions with limited fresh meat access, offering convenience and extended shelf life. The growing demand for premium, natural food choices continues to propel the fresh halal meat market forward.

By Distribution Channel Analysis

In 2024, Convenience Stores dominated the halal meat market with a 72.4% share, driven by their accessibility, extended hours, and consumer trust. These stores cater to on-the-go lifestyles, offering quick access to halal meat products. Their emphasis on quality, safety, and halal certification strengthens consumer confidence. Additionally, supermarkets and hypermarkets leverage their scale, competitive pricing, and promotions, further expanding halal meat accessibility. The segment’s dominance highlights the growing demand for efficient and reliable grocery procurement.

By End-user Analysis

In 2024, the Household Segment led the halal meat market with a 34.5% share, driven by rising investments in restaurants, catering, and institutional dining. Households remain a key consumer base, while halal-certified eateries and food services cater to those prioritizing religious dietary adherence. The growing dining-out trend boosts demand for halal-certified meals, reinforcing market growth. Additionally, the post-pandemic recovery of the hospitality sector, with the U.S. hotel market reaching USD 258 billion, further supports this expansion.

Buy Now: https://market.us/purchase-report/?report_id=105365

Key Market Segments

By Type

• Poultry

• Beef

• Sheep & Goat

• Others

By Certification Type

• Halal Certification

• Non-Certified

By Packaging Type

• Fresh meat

• Frozen meat

By End-User

• Household Consumers

• Food Service Sector

• Retailers

• Others

By Distribution Channel

• Supermarkets/Hypermarkets

• Convenience Stores

• Online Retail

• Others

Top Emerging Trends

1. Growing Popularity of Organic Halal Meat: Consumers are increasingly seeking organic halal meat due to concerns over health, ethical sourcing, and sustainability. Organic halal meat ensures that livestock is raised without synthetic hormones, antibiotics, or genetically modified feed, aligning with clean-eating trends. This shift is driven by rising health awareness and a preference for natural, minimally processed foods. As regulatory bodies strengthen organic standards, halal meat producers are integrating organic farming practices to meet consumer demand. This trend is expected to drive premium market growth and reshape industry dynamics.

2. Expansion of Online Halal Meat Sales: The rise of e-commerce has transformed the halal meat market, with online platforms offering convenient access to certified products. Consumers prefer online purchases due to home delivery options, wider product choices, and transparent halal certification details. Digital platforms are also integrating blockchain technology for enhanced traceability. The increasing use of mobile apps and subscription services is further streamlining meat procurement. This trend is expected to grow, especially in urban markets where busy lifestyles drive demand for efficient, high-quality halal meat sourcing.

3. Increasing Demand for Processed Halal Meat: The demand for processed halal meat products—such as ready-to-eat meals, frozen foods, and deli meats—is rising, driven by changing lifestyles and convenience needs. Urbanization and fast-paced routines encourage consumers to choose pre-packaged, easy-to-cook halal meat options. Additionally, food manufacturers are expanding halal-certified product lines to cater to Muslim and non-Muslim consumers alike. The growing presence of halal fast food chains, supermarkets, and hypermarkets is further boosting this segment, making processed halal meat a key driver of industry growth.

4. Blockchain and AI in Halal Meat Traceability: Technology is playing a crucial role in halal meat authentication, with blockchain and AI-driven traceability ensuring compliance with halal standards. Blockchain allows real-time tracking of meat sources, verifying ethical and halal-compliant slaughtering processes. AI is helping automate quality checks and fraud detection, improving consumer confidence. As fraudulent halal claims remain a concern, governments and certifying bodies are increasingly adopting digital solutions to enhance supply chain transparency. This trend is reshaping the halal meat trade, ensuring authenticity and trust in the global market.

5. Rise of Halal Meat in Non-Muslim Markets: Halal meat is gaining traction beyond Muslim consumers, appealing to those prioritizing ethical sourcing, hygiene, and high-quality protein. Many perceive halal meat as cleaner and healthier, leading to increased demand in Western markets, health-conscious communities, and alternative diet followers. Fast-food chains and mainstream retailers are expanding halal-certified offerings to cater to a diverse customer base. As halal certification becomes more recognized globally, halal meat is transitioning from a religious preference to a mainstream dietary choice, driving significant market expansion.

Regulations on the Halal Meat Market

The halal meat market is governed by a complex set of regulations that ensure compliance with Islamic dietary laws. These regulations vary by country but typically cover slaughtering methods, processing, packaging, labeling, and certification.

The core requirement is that animals must be slaughtered by a Muslim using a sharp knife, with a swift cut to the throat while invoking the name of Allah. Stunning before slaughter is a debated issue, with some authorities permitting reversible stunning, while others strictly prohibit it.

Regulatory bodies such as the Halal Certification Authority, Islamic Food and Nutrition Council, and national halal certification agencies oversee compliance. Countries like Malaysia, Indonesia, and Saudi Arabia have strict halal certification frameworks, while Western nations have adapted their food safety regulations to accommodate halal standards. The European Union, for instance, mandates that animal welfare laws be balanced with religious slaughter practices.

Labeling requirements also play a key role, in ensuring transparency for consumers. Many countries mandate halal certification logos on packaging, along with traceability measures. In non-Muslim-majority regions, halal meat businesses must comply with both general food safety regulations and specific halal guidelines, creating a dual regulatory burden. This evolving regulatory landscape continues to shape the global halal meat trade.

Regional Analysis

Asia Pacific leads the global halal meat market, driven by its rapidly expanding Muslim population. In 2023, the region accounted for a significant market share of 38.9%, reinforced by strong consumer demand across key countries such as Indonesia, Pakistan, Malaysia, and India—home to some of the world’s largest Muslim populations. This demographic foundation ensures a steady and growing demand for halal-certified meat products.

Additionally, substantial investments in halal food certification and regulatory frameworks across Asia Pacific have strengthened consumer confidence in product authenticity. These advancements have also positioned the region as a key player in the global halal meat supply chain, both for domestic consumption and international exports.

Beyond Asia Pacific, the Middle East and Africa remain crucial markets, driven by strict adherence to Islamic dietary laws. Countries like Saudi Arabia, the UAE, and South Africa play a significant role in the halal meat industry, not only as major consumers but also as exporters. The region’s commitment to maintaining high halal certification standards reinforces its influence in the global market, ensuring a continuous demand for halal meat products across domestic and international markets.

Key Players Analysis

◘ BRF Global

◘ Amana Foods

◘ Al Islami Foods

◘ Tariq Halal

◘ Tahira Foods Ltd

◘ SIS Company

◘ Al Kabeer Group ME

◘ Prairie Halal Foods

◘ Nema Halal

◘ Thomas International

◘ Al-Aqsa

◘ DOUX

◘ Herd & Grace

◘ Other Key Players

Recent Developments of the Halal Meat Market

— In 2024, the second quarter of 2024, BRF reported a net profit of R$1.1 billion, marking its best second-quarter performance to date.

— In 2023, Nema Halal maintained its unique position as the only plant in the USA and Canada with both slaughtering and processing facilities under one roof, ensuring premium quality halal food.

Strategic Initiatives

— Product Portfolio Expansion: Companies are investing in R&D to develop advanced formulations that meet regulatory and consumer demands.

— Geographic Expansion: Focus on high-growth regions like Asia-Pacific and the Middle East to capitalize on industrialization trends.

— Sustainability Initiatives: Efforts to align with global sustainability goals and minimize environmental

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.