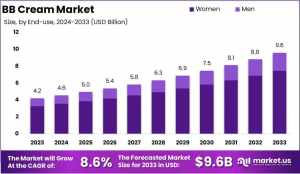

BB Cream Market Size, Share to Hit USD 9.6 Billion by 2033, Growing at a CAGR of 8.6%

BB Cream Market projected to hit USD 9.6 Billion by 2033 from USD 4.2 Billion in 2023, growing at a CAGR of 8.6% during 2024-2033.

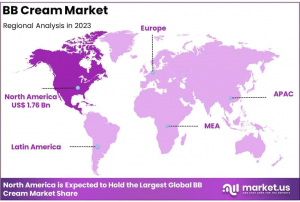

North America dominates the BB Cream market with a 42% share in 2023, valued at USD 1.76 Billion. Unlock up to 30% off—Buy Now!”

NEW YORK, NY, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- **Report Overview**— Tajammul Pangarkar

The Global BB Cream Market is projected to reach approximately USD 9.6 billion by 2033, up from USD 4.2 billion in 2023, with a compound annual growth rate (CAGR) of 8.6% during the forecast period of 2024 to 2033.

BB Cream, short for "Blemish Balm" or "Beauty Balm," is a versatile skincare and cosmetic product that combines the benefits of moisturizer, sunscreen, primer, and foundation into a single formula. Designed to streamline skincare routines, BB Creams offer hydration, sun protection, and a lightweight coverage that evens out skin tone. With a texture that is less dense than traditional foundations, BB Creams cater to individuals seeking a natural, radiant look while also addressing skincare concerns such as dryness, blemishes, and uneven pigmentation. This multi-functional product has gained global traction due to its ability to simplify beauty regimens without compromising effectiveness.

The BB Cream market has evolved significantly, driven by a surge in demand for multifunctional and time-efficient skincare solutions. It encompasses a wide range of formulations tailored to various skin types, tones, and concerns, offered by key players in the cosmetics industry. Market growth is fueled by the increasing popularity of hybrid beauty products, particularly among consumers who value convenience and efficacy. The expanding influence of social media and beauty influencers has further propelled awareness and adoption, making BB Cream a staple in modern beauty routines.

Request Your Sample Report Today for In-Depth Insights and Analysis at https://market.us/report/bb-cream-market/request-sample/

Key growth factors include rising consumer inclination toward skincare with added cosmetic benefits, advancements in product innovation, and increasing awareness of sun protection. Demand is bolstered by a growing interest in clean and natural formulations, appealing to eco-conscious consumers. The shift toward e-commerce and digital retail platforms also provides a significant opportunity for market expansion, enabling brands to reach diverse and global audiences effectively.

**Key Takeaways**

~~ The BB Cream market is projected to grow from USD 4.2 billion in 2023 to USD 9.6 billion by 2033, registering a CAGR of 8.6% during the forecast period.

~~ BB creams for combination skin led the market, capturing a 27% share in 2023.

~~ Women dominated the market, accounting for 78% of total end-use share in 2023.

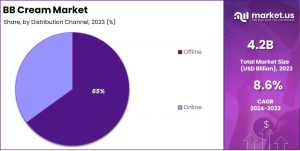

~~ Offline channels held a significant market share of 65% in 2023.

~~ North America led the market with a 42% share, attributed to a robust beauty industry and a strong consumer base.

**Market Segmentation**

In 2023, the BB cream market was led by the combination skin segment, which held a 27% share due to its versatile formulations addressing both dryness and oiliness. Oily skin BB creams followed with a 22% share, driven by demand for mattifying and lightweight properties, while dry skin products accounted for 18%, fueled by interest in hydrating ingredients like hyaluronic acid. Normal skin BB creams captured 17% of the market, appealing broadly with tone-enhancing, non-targeted formulations. Sensitive skin products held 16%, catering to niche consumers seeking hypoallergenic and soothing solutions.

In 2023, women dominated the global BB cream market with a 78% share, driven by the rising demand for multifunctional skincare products offering hydration, coverage, and sun protection. The trend of minimalist beauty routines among women aged 18-35 and targeted marketing efforts have solidified their position in the market. While the men's segment holds a smaller share, it is growing rapidly due to increasing awareness of male grooming and the appeal of lightweight, convenient BB cream formulations tailored for men.

In 2023, BB creams with SPF 30-50 dominated the global market, capturing 44% of sales due to rising consumer preference for effective sun protection combined with skincare benefits. Increased awareness of UV-related risks, such as premature aging and skin cancer, has driven demand for higher SPF formulations. While the Below 15 SPF category serves a niche market, and the 15-30 SPF range appeals to everyday users, the Above 50 SPF segment is gaining traction, particularly in high UV regions, signaling growth potential as sun protection becomes a priority in skincare choices.

In 2023, offline channels, including supermarkets, specialty stores, and pharmacies, dominated the BB cream market with over 65% share, driven by consumers' preference for in-store shopping, expert consultations, and promotional activities. However, the online segment is steadily growing due to the convenience of e-commerce, competitive pricing, and wider product availability, positioning it for significant expansion as digital adoption accelerates.

**Key Market Segments**

By Skin Type

~~ Dry

~~ Normal

~~ Oily

~~ Combination

~~ Sensitive

By End-use

~~ Women

~~ Men

By SPF

~~ Below 15 SPF

~~ Between 15-30 SPF

~~ Between 30-50 SPF

~~ Above 50 SPF

Distribution Channel

~~ Offline

~~ Online

**Driving factors**

Increasing Demand for Multi-Functional Skincare Products

The global BB cream market is witnessing robust growth, driven by the rising demand for multi-functional skincare products. Consumers today are prioritizing simplicity and convenience in their beauty routines, seeking products that offer multiple benefits in a single formulation. BB creams, known for their ability to combine skincare and makeup functions, meet this demand by providing hydration, sun protection, and light coverage. This versatility has made BB creams particularly appealing to millennials and Gen Z, who prefer efficient beauty solutions.

"Order the Complete Report Today to Receive Up to 30% Off at https://market.us/purchase-report/?report_id=63229

**Restraining Factors**

Presence of Alternative Products in the Market

While BB creams have carved out a significant share in the skincare industry, the market faces challenges from alternative products, including CC creams and tinted moisturizers. These alternatives often target specific consumer needs, such as advanced color correction or a more lightweight feel, which may detract from BB cream sales. The intense competition in the beauty sector, coupled with rapidly evolving consumer preferences, creates pressure on manufacturers to differentiate their offerings.

**Growth Opportunity**

Expansion into Men’s Skincare Segment

The men’s grooming industry represents a significant growth opportunity for the BB cream market. As societal norms around male grooming evolve, there is increasing acceptance of cosmetic products for men. BB creams tailored to men’s skincare needs, such as oil control and lightweight formulations, are gaining traction in both mature and emerging markets. This trend aligns with the broader shift towards self-care and grooming among male consumers.

**Latest Trends**

Growing Popularity of Clean and Natural Beauty Products

The clean beauty movement is reshaping consumer preferences, driving demand for BB creams formulated with natural and organic ingredients. As consumers become more conscious of the potential harm caused by synthetic chemicals in cosmetics, they are gravitating toward products that align with their values of sustainability and health. This trend is particularly pronounced among younger consumers who prioritize eco-friendly and cruelty-free brands.

**Regional Analysis**

North America Dominates BB Cream Market with Largest Market Share of 42%

The BB Cream market exhibits significant regional variations, with North America leading as the dominant region, capturing a substantial market share of 42% in 2023. The region's market size is valued at USD 1.76 billion, driven by strong consumer demand for multifunctional beauty products and increasing awareness of skincare. Europe follows as a key market, with robust growth fueled by innovation in product formulations and a high adoption rate of premium cosmetic products.

Meanwhile, Asia Pacific shows promising growth, underpinned by rising disposable incomes, a growing beauty-conscious population, and the influence of Korean beauty trends. The Middle East & Africa and Latin America contribute steadily, with growing urbanization and an expanding retail network driving demand. North America's dominance highlights its strong consumer base and preference for advanced beauty solutions, making it the largest market for BB Creams globally.

!! Request Your Sample PDF to Explore the Report Format !!

**Key Players Analysis**

The global BB cream market in 2024 is characterized by intense competition among key players, each leveraging its strengths to capture market share. Procter & Gamble and Unilever focus on mass-market consumers with their extensive distribution networks and affordable product lines. L'Oréal Groupe and Estée Lauder Companies dominate the premium segment, offering high-performance formulations backed by strong brand equity and extensive R&D efforts. Shiseido Company, Limited and CHANEL target the luxury market, emphasizing innovation and unique product experiences to cater to discerning customers.

LVMH continues to drive demand through its portfolio of high-end beauty brands, benefiting from its luxury heritage. Coty Inc. and Revlon prioritize branding and strategic partnerships to sustain their market presence, while Avon Products capitalizes on its direct-selling model to reach untapped regions. Collectively, these players invest heavily in marketing, product diversification, and sustainability initiatives to remain competitive in this dynamic and evolving industry.

Top Key Players in the Market

~~ Procter & Gamble

~~ Shiseido Company, Limited

~~ LVMH

~~ L’ORÉAL GROUPE

~~ Coty Inc.

~~ Unilever

~~ Estée Lauder Companies

~~ Avon Products

~~ CHANEL

~~ Revlon

**Recent Developments**

~~ In 2023: L’Oréal finalized the acquisition of luxury beauty brand Aesop, focusing on growth in China. CEO Nicolas Hieronimus highlighted Aesop’s urban sophistication and luxury appeal.

~~ In 2023: Oddity, the parent company of Il Makiage and Spoiled Child, acquired biotech startup Revela for $76 million, establishing a Boston-based lab to drive innovation in beauty and biotech.

~~ In 2023: Famille C Participations, the investment arm of the Clarins-owning Courtin family, became the majority shareholder of Pai Skincare. Following a £14 million Series C funding, the brand plans UK and European expansion, strengthening ties with retailers like John Lewis and Sephora.

~~ In 2024: Givaudan acquired the remaining 75% of b.kolormakeup & skincare, supporting its 2025 strategy to expand in beauty. This acquisition enhances its expertise in makeup and skincare alongside fragrances and haircare.

**Conclusion**

The global BB Cream market is on a robust growth trajectory, projected to reach USD 9.6 billion by 2033, driven by rising demand for multifunctional skincare solutions, product innovation, and evolving beauty trends. North America leads the market, with Asia Pacific showing strong growth potential fueled by K-beauty influence and increasing disposable income. Despite competition from alternative products like CC creams, opportunities in men’s grooming and clean beauty trends present significant avenues for growth. Key players continue to innovate and expand their reach, ensuring the market remains dynamic and competitive.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.