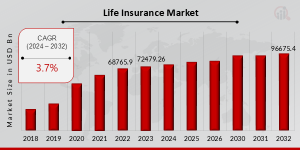

Life Insurance Market Set to Achieve a Valuation of USD 96675.4 Billion, Riding on a 3.7% CAGR by 2032

Life Insurance Market Research Report By, Product Type, Distribution Channel, Premium Range, Target Audience, Coverage Type, Regional

MS, UNITED STATES, January 20, 2025 /EINPresswire.com/ -- The global Life Insurance Market is experiencing steady growth and is anticipated to continue expanding over the next decade. In 2022, the market size was estimated at USD 68,765.9 billion and is projected to grow from USD 72,479.2 billion in 2023 to an impressive USD 96,675.4 billion by 2032. This growth reflects a compound annual growth rate (CAGR) of approximately 3.7% during the forecast period (2024–2032). Factors such as the increasing awareness of financial security, rising disposable income, and the expansion of insurance products tailored to different consumer needs are driving the market's growth.Key Drivers of Market Growth

Increasing Awareness of Financial Security As people become more aware of the importance of long-term financial planning and security, the demand for life insurance products is rising. Insurance companies are witnessing increased consumer interest in both term life and whole life policies, especially as individuals look for ways to protect their families and loved ones from financial hardship.

Rising Disposable Income In many parts of the world, particularly in emerging markets, rising disposable income is enabling more people to invest in life insurance policies. As personal incomes increase, consumers are more likely to prioritize life insurance as part of their overall financial strategy.

Aging Population With a growing global aging population, particularly in developed regions, the demand for life insurance is expected to increase. Older individuals are looking for life insurance policies that can provide financial support to their beneficiaries after their passing, as well as potential coverage for retirement planning.

Technological Advancements Advances in technology are transforming the life insurance sector, with digital platforms simplifying the purchasing process and improving customer experience. The use of artificial intelligence, data analytics, and digital tools is allowing insurers to offer more personalized policies, attract younger consumers, and enhance operational efficiency.

Growth of Emerging Markets Emerging markets, particularly in Asia-Pacific and Latin America, are contributing significantly to the growth of the life insurance market. As these regions experience rapid economic development and rising middle-class populations, more individuals are investing in life insurance products to safeguard their financial future.

Download Sample Pages https://www.marketresearchfuture.com/sample_request/22927

Key Companies in the Life Insurance Market

• Zurich

• China Life

• Manulife

• Aegon

• Prudential

• State FarmparaneMetLife AliconeNew China Life

• AXA

• Aviva

• MetLife

• Berkshire Hathway

• Allianz

• Nippon Life

• Sun Life

Browse In – Depth Market Research Report : https://www.marketresearchfuture.com/reports/life-insurance-market-22927

Market Segmentation

To provide a detailed analysis, the life insurance market is segmented based on type, distribution channel, end-user, and region.

1. By Type

Term Life Insurance: Provides coverage for a specific period, typically 10, 20, or 30 years.

Whole Life Insurance: Offers lifelong coverage and includes an investment component.

Universal Life Insurance: Combines permanent coverage with a flexible savings component.

Variable Life Insurance: Allows policyholders to invest in various securities.

2. By Distribution Channel

Direct Channel: Policies sold directly through insurance companies via online platforms or agents.

Brokers/Intermediaries: Life insurance policies sold through brokers, financial advisors, or other intermediaries.

Banks: Banks partnering with insurance providers to offer life insurance products to their customers.

3. By End-User

Individual: Policies purchased by individuals for personal coverage and financial planning.

Corporate: Group life insurance plans purchased by employers for their employees.

4. By Region

North America: Dominates the market, driven by high awareness and a mature life insurance market.

Europe: Steady growth due to the presence of established insurance companies and an aging population.

Asia-Pacific: Fastest-growing region, fueled by expanding middle-class populations and increasing disposable incomes.

Rest of the World (RoW): Moderate growth in regions such as Latin America, the Middle East, and Africa, with expanding access to life insurance products.

Procure Complete Research Report Now : https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=22927

The life insurance market is set for steady growth, driven by factors such as increasing awareness of financial security, rising disposable income, and advancements in insurance technology. With a projected CAGR of 3.7% from 2024 to 2032, the market is expected to reach USD 96,675.4 billion by the end of the forecast period. The market's expansion is also supported by the growing aging population, the rise of emerging markets, and innovations in product offerings. As life insurance continues to evolve, it will play a crucial role in providing financial protection and peace of mind to individuals worldwide.

Related Report -

Nfc Payments Market

https://www.marketresearchfuture.com/reports/nfc-payments-market-22579

Umbrella Insurance Market

https://www.marketresearchfuture.com/reports/umbrella-insurance-market-22580

Cryptocurrency Exchange Platform Market

https://www.marketresearchfuture.com/reports/cryptocurrency-exchange-platform-market-22319

Community Banking Market

https://www.marketresearchfuture.com/reports/community-banking-market-23687

Explosion Proof Equipment System Market

https://www.marketresearchfuture.com/reports/explosion-proof-equipment-system-market-23855

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.