Loan Servicing Global Market 2024 To Reach $4.64 Billion By 2028 At Rate Of 16.6%

The Business Research Company’s Loan Servicing Global Market Report 2024 – Market Size, Trends, And Market Forecast 2024-2033

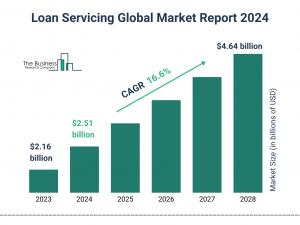

LONDON, GREATER LONDON, UNITED KINGDOM, October 10, 2024 /EINPresswire.com/ -- The loan servicing market has seen rapid growth, increasing from $2.16 billion in 2023 to $2.51 billion in 2024 at a CAGR of 16.3%. This growth is driven by regulatory changes, rising loan origination volumes, demand for automation, and increased focus on borrower expectations and data security.

What Is The Estimated Market Size Of The Global Loan Servicing Market And Its Annual Growth Rate?

The loan servicing market will see rapid growth, reaching $4.64 billion by 2028 at a CAGR of 16.6%. Key growth factors include the need for automation, regulatory compliance, mortgage sector expansion, and scalable solutions for loan portfolios. Trends include AI-driven automation, blockchain, advanced analytics, digital platforms, and cloud-based scalability.

Explore Comprehensive Insights Into The Global Loan Servicing Market With A Detailed Sample Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18661&type=smp

Growth Driver of The Loan Servicing Market

The rise in business startups is expected to propel the growth of the loan servicing market. Business startups are newly established companies in the early stages of development. The increase in these startups is attributed to the availability of funding options, a growing entrepreneurial culture, and emerging market trends. Startups often require various loans, including working capital, equipment financing, and lines of credit, necessitating specialized servicing to accommodate diverse terms and borrower needs.

Explore The Report Store To Make A Direct Purchase Of The Report:

https://www.thebusinessresearchcompany.com/report/loan-servicing-global-market-report

Which Market Players Are Driving The Loan Servicing Market Growth?

Major companies operating in the loan servicing market are Wells Fargo & Company, HSBC Holdings plc, Citibank N.A., U.S. Bancorp , PNC Financial Services Group Inc., M&T Bank Corporation, Fifth Third Bank, Regions Financial Corporation, Fairway Independent Mortgage Corp., Rocket Mortgage, Flagstar Bank, Fairway Independent Mortgage Corp., Rocket Mortgage, Flagstar Bank, Zions Bank, Mr. Cooper Group Inc., Caliber Home Loans Inc., PennyMac Loan Services Inc., United Wholesale Mortgage, Guild Mortgage, LoanDepot, Movement Mortgage, Ocwen Financial Solutions Pvt. Ltd, PrimeLending, The PHH Corporation

What Are The Emerging Trends Shaping The Loan Servicing Market Size?

The loan servicing market is seeing innovation as companies develop loan servicing platforms tailored for direct lenders, enhancing operational efficiency through automation and analytics. These platforms streamline the loan management process and improve borrower experiences by providing end-to-end administrative solutions for direct lenders.

How Is The Global Loan Servicing Market Segmented?

1) By Type: Conventional Loans, Conforming Loans, Federal Housing Administration (FHA) Loan, Private Money Loans, Hard Money Loans

2) By Component: Software, Service

3) By Deployment: On-Premise, Cloud-Based

4) By Lender Type: Local Bank, Government-Sponsored Enterprise (GSE), Private Organization

Geographical Insights: North America Leading The Loan Servicing Market

North America was the largest region in the market in 2023. Europe is expected to be the fastest-growing region in the forecast period. The regions covered in the loan servicing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Loan Servicing Market Definition

Loan servicing encompasses the administrative tasks associated with managing a loan from the time it is disbursed until it is fully paid off. This involves ensuring timely payments and maintaining the loan in good standing to benefit both lenders and borrowers.

Loan Servicing Global Market Report 2024 from The Business Research Company covers the following information:

• Market size data for the forecast period: Historical and Future

• Macroeconomic factors affecting the market in the short and long run

• Analysis of the macro and micro economic factors that have affected the market in the past five years

• Market analysis by region: Asia-Pacific, China, Western Europe, Eastern Europe, North America, USA, South America, Middle East and Africa.

• Market analysis by countries: Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA.

An overview of the global loan servicing market report covering trends, opportunities, strategies, and more

The Loan Servicing Global Market Report 2024 by The Business Research Company is the most comprehensive report that provides insights on loan servicing market size, drivers and trends, loan servicing market major players, competitors' revenues, market positioning, and market growth across geographies. The market report helps you gain in-depth insights into opportunities and strategies. Companies can leverage the data in the report and tap into segments with the highest growth potential.

Browse Through More Similar Reports By The Business Research Company:

Personal Loans Market 2024

https://www.thebusinessresearchcompany.com/report/personal-loans-global-market-report

Loan Origination Software Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/loan-origination-software-global-market-report

Asset Servicing Global Market Report 2024

https://www.thebusinessresearchcompany.com/report/asset-servicing-global-market-report

What Does the Business Research Company Do?

The Business Research Company publishes over 15,000 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders. We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including a Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package, and much more.

Our flagship product, the Global Market Model is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Oliver Guirdham

The Business Research Company

+44 20 7193 0708

info@tbrc.info

Visit us on social media:

Facebook

X

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.