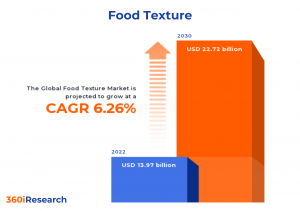

Food Texture Market worth $22.72 billion by 2030, growing at a CAGR of 6.26% - Exclusive Report by 360iResearch

The Global Food Texture Market to grow from USD 13.97 billion in 2022 to USD 22.72 billion by 2030, at a CAGR of 6.26%.

PUNE, MAHARASHTRA, INDIA , November 10, 2023 /EINPresswire.com/ -- The "Food Texture Market by Product (Cellulose Derivatives, Dextrins, Esters), Form (Liquid, Powder), Function, Source, Application - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Food Texture Market to grow from USD 13.97 billion in 2022 to USD 22.72 billion by 2030, at a CAGR of 6.26%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/food-texture?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

The food texture market is a vital segment within the food industry, focusing on enhancing and optimizing various food products' sensory and functional properties using texturing agents, technological advancements, and innovative processing techniques. This market caters to consumer preferences for specific textures in diverse applications such as dairy products, bakery items, confectionery, beverages, and meat alternatives. Growing demand for convenience and ready-to-eat food from consumers fuelling the food texture market. In addition, growing awareness of food texture hypersensitivity and sensory processing disorder and the rising use of food textures to improve the stability and texture of processed meat led manufacturers to explore innovative solutions to cater to these demands. The fluctuating cost of raw materials required for producing food textures potentially affects pricing strategies, and quality issues associated with food textures are limiting the market growth. Growing consumer inclination towards plant-based food textures provides sustainable alternatives to traditional solutions, appealing to environmentally conscious consumers. In addition, the increasing development of new processing techniques for food textures, such as 3D printing and high-pressure processing for customized textures, creates significant market growth opportunities.

Type: Increasing demand for starch as a binding agent in various food products

Cellulose derivatives are the thickeners and stabilizers in dairy products, sauces, and dressings. Dextrins are derived from starch, contribute to browning reactions in baked goods, and act as viscosity modifiers in sauces. Esters are organic compounds that function as emulsifiers to enhance stability within food systems such as dressings or spreads. Gelatin agents are derived from animal collagen used for confectionery items and desserts due to their thermoreversible gel-forming properties that offer excellent stability. Gums are the hydrocolloids that provide thickening functionality across various food applications, including beverages and baked goods. Inulin, a soluble fiber, is derived from the chicory root, which serves as a prebiotic ingredient and fat replacer in baked goods and frozen desserts. Pectin is a natural polysaccharide extracted from fruits that acts as a gelling agent in jams, jellies, and acidified dairy products such as yogurt. Starch is widely used as a thickening agent for food products such as snacks, soups, and sauces due to its water absorption capacity and textural versatility.

Application: Increased utilization for texture agent in sauces, dressings, and condiments for consistency and thickness

The beverage industry requires specific food textures to enhance consumers' mouthfeel and sensory experience. These include smooth, creamy, and frothy textures in dairy-based drinks such as milkshakes and coffee beverages and thickening agents for fruit juices and cocktails. Food texture is crucial in determining the quality of confectioneries and bakery products. Factors such as chewiness in candies, crispness in cookies, or softness in cakes are essential for consumer satisfaction. Dairy products demand textures ranging from smooth yogurts to firm cheeses or whipped creams, and consumers often prefer creamier textures that deliver a rich mouthfeel. From processed meats such as sausages to plant-based alternatives, texture is a key factor affecting consumer preferences. Texturizing agents improve mouthfeel, juiciness, and tenderness while maintaining product stability. Consistency and thickness influence consumer preferences for sauces, dressings, and condiments. Crispiness, crunchiness, and mouthfeel are essential factors in determining the success of sweet and savory snacks.

Form: Wider adoption of powdered food texture due to its convenience, storage capacity, and customization option

Liquid food textures cater to individuals with swallowing or chewing difficulties due to conditions such as dysphagia, dental issues, or old age. Common liquid foods include soups, smoothies, and meal replacement shakes, offering comfort and ease of consumption while providing essential nutrients. Powdered food textures target on-the-go nutrition and longer shelf life without sacrificing nutritional value. These products include protein powders, powdered milk, instant soup mixes, and meal replacement powders that dissolve in water or milk. The need-based preference revolves around convenience, storage capacity, and customization options. Liquid food textures provide easy consumption for those facing swallowing challenges, while powdered textures offer convenience and customization options for a broader consumer base. Both forms have shifted towards plant-based ingredients driven by the demand for healthier alternatives.

Function: Rising popularity of stabilizing agents in the dairy applications

Emulsifying agents enable immiscible ingredients such as oil and water to form stable emulsions in products such as salad dressings and mayonnaise. Gelling agents create structure by forming gels in foods such as jellies, jams, desserts, and confectionery products. Stabilizing additives maintain product consistency by preventing separation or sedimentation of components throughout shelf life, essential in dairy products, frozen desserts, beverages, and sauces. Thickening agents increase viscosity without altering properties, including taste or appearance, utilized in soups, sauces, gravies, and bakery products. Food texture additive selection depends on the desired function and application requirements. Consumer preferences for plant-based, clean-label, reduced-fat/sugar products drive market innovations. Leading manufacturers concentrate on research and development to cater to emerging trends while preserving the sensory appeal of food products.

Source: Growing use of natural textures with changing consumer preferences

Natural textures stem from raw materials such as fruits, vegetables, grains, and animal products, offering authentic sensory experiences. Synthetic textures are artificially created using chemical compounds or modified natural ingredients such as hydrocolloids and emulsifiers. They cater to consumers seeking specific characteristics in their food products, such as extended shelf life or improved stability. Consumer preferences largely influence market demand for both natural and synthetic food textures. With growing awareness surrounding clean labels and health-oriented diets, natural textures are gaining popularity; however, synthetic textures remain crucial for specialized products with unique mouthfeel experiences or functional properties. Natural textures convey a sense of quality and freshness as they originate from raw ingredients. In contrast, synthetic textures offer versatility to meet specific product needs, including extending shelf life or improving stability. Natural and synthetic food textures have their niche in the market based on consumer preferences and functional demands.

Regional Insights:

In the Americas, the demand for food texture is driven by consumers' preference for processed and convenient foods. The North American region, particularly the United States and Canada, is highly inclined toward ready-to-eat meals, snacks, and beverages, emphasizing mouthfeel enhancement through food texture modifications. Health-conscious consumers seek out products that offer a balance between nutrition and indulgence. In Europe, traditional culinary practices emphasize natural ingredients and textures inherent to their regional cuisine; however, changing lifestyles have given rise to a need for convenience food without compromising quality. Consumers in this region prioritize sensory appeal when choosing food products, and factors such as taste and mouthfeel are considered equally important as appearance or aroma. The Middle Eastern and African markets exhibit similar preferences but face challenges due to the limited infrastructure and resources required for advanced food processing techniques. The APAC region has experienced the most rapid growth in the food texture market due to changing dietary habits, urbanization, and rising disposable incomes. Cultural traditions and local cuisine drive food preferences in this region, but consumers increasingly appreciate innovative textures, especially from established global brands. Substantial investments aim at developing products that blend traditional ingredients with innovative textural properties.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Food Texture Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Food Texture Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Food Texture Market, highlighting leading vendors and their innovative profiles. These include Agarmex, S.A. de C.V., Ajinomoto Co., Inc., Altrafine Gums, AngelYeast Co., Ltd., Archer Daniels Midland Company, Arla Foods Ingredients Group P/S, Ashland Inc., Axiom Foods, Inc., B&V srl, BASF SE, Batory Foods, BENEO GmbH, Bhansali International, Bunge Limited, Cargill, Incorporated, Corbion NV, CP Kelco U.S., Inc. by J.M. Huber Corporation, Dairy Farmers of America, Inc., Darling Ingredients Inc., Deosen Biochemical (Ordos) Ltd., DuPont de Nemours, Inc, EPI Ingredients, Estelle Chemicals Pvt. Ltd., Fiberstar, Inc., GELITA AG, Givaudan SA, Ingredion Incorporated, International Flavors & Fragrances Inc., Jungbunzlauer Suisse AG, Kerry Group PLC, Mitsubishi Chemical Group Corporation, Motif FoodWorks, Inc., Nexira, Novozymes A/S, Palsgaard A/S, Riken Vitamin Co., Ltd., Roquette Frères S.A., Royal DSM, Sensus B.V. by Coöperatie Koninklijke Cosun U.A., Symrise AG, and Tate & Lyle PLC.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/food-texture?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Food Texture Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Product, market is studied across Cellulose Derivatives, Dextrins, Esters, Gelatins, Gums, Inulin, Pectin, and Starch. The Cellulose Derivatives commanded largest market share of 26.60% in 2022, followed by Starch.

Based on Form, market is studied across Liquid and Powder. The Liquid commanded largest market share of 62.85% in 2022, followed by Powder.

Based on Function, market is studied across Emulsifying, Gelling, Stabilizing, and Thickening. The Stabilizing commanded largest market share of 33.58% in 2022, followed by Emulsifying.

Based on Source, market is studied across Natural and Synthetic. The Natural commanded largest market share of 75.85% in 2022, followed by Synthetic.

Based on Application, market is studied across Beverages, Confectioneries & Bakery products, Dairy Products, Meat Products, Sauces, Dressings & Condiments, and Sweet & Savory Snacks. The Beverages commanded largest market share of 34.46% in 2022, followed by Confectioneries & Bakery products.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 41.52% in 2022, followed by Europe, Middle East & Africa.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Food Texture Market, by Product

7. Food Texture Market, by Form

8. Food Texture Market, by Function

9. Food Texture Market, by Source

10. Food Texture Market, by Application

11. Americas Food Texture Market

12. Asia-Pacific Food Texture Market

13. Europe, Middle East & Africa Food Texture Market

14. Competitive Landscape

15. Competitive Portfolio

16. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Food Texture Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Food Texture Market?

3. What is the competitive strategic window for opportunities in the Food Texture Market?

4. What are the technology trends and regulatory frameworks in the Food Texture Market?

5. What is the market share of the leading vendors in the Food Texture Market?

6. What modes and strategic moves are considered suitable for entering the Food Texture Market?

Read More @ https://www.360iresearch.com/library/intelligence/food-texture?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.